New analysis from Common Wealth finds the total value of corporate bonds issued by fossil fuel firms has increased by 188% since 2016.

- Top twenty asset management companies hold over $149 billion in bonds issued by oil, gas and coal companies.

- US investment giants BlackRock and Vanguard are dominant in the industry, holding $55.7 billion worth top oil, gas and coal company bonds.

- The findings come after the Toxic Bonds Network publishes its ‘Dirty Thirty’ list, compiling the top thirty fossil fuel companies funding their expansion on the bond market.

Common Wealth today published a new database in partnership with the Toxic Bonds Network to shine a light on the growing role of corporate bonds in propping up the fossil fuel industry. The Network is calling for financial institutions to immediately deny debt to companies expanding fossil fuel and to instead invest in bonds that support a just transition in which global heating is limited to 1.5 degrees.

The database, developed by Common Wealth Data Analyst Sophie Flinders, finds that the top twenty asset management companies collectively hold a minimum of at least $180 billion worth of bonds in oil, gas and coal companies, identified in Urgewald’s Global Coal Exit List 2022 and Global Oil and Gas Exit List 2022.

The firms with the five largest holdings of bonds invested in fossil fuels or ‘toxic bonds’ are Vanguard ($31.8 bn), BlackRock ($29.9 bn), AXA ($21.1 bn), Prudential ($14.5 bn), and Fidelity ($12.5 bn).

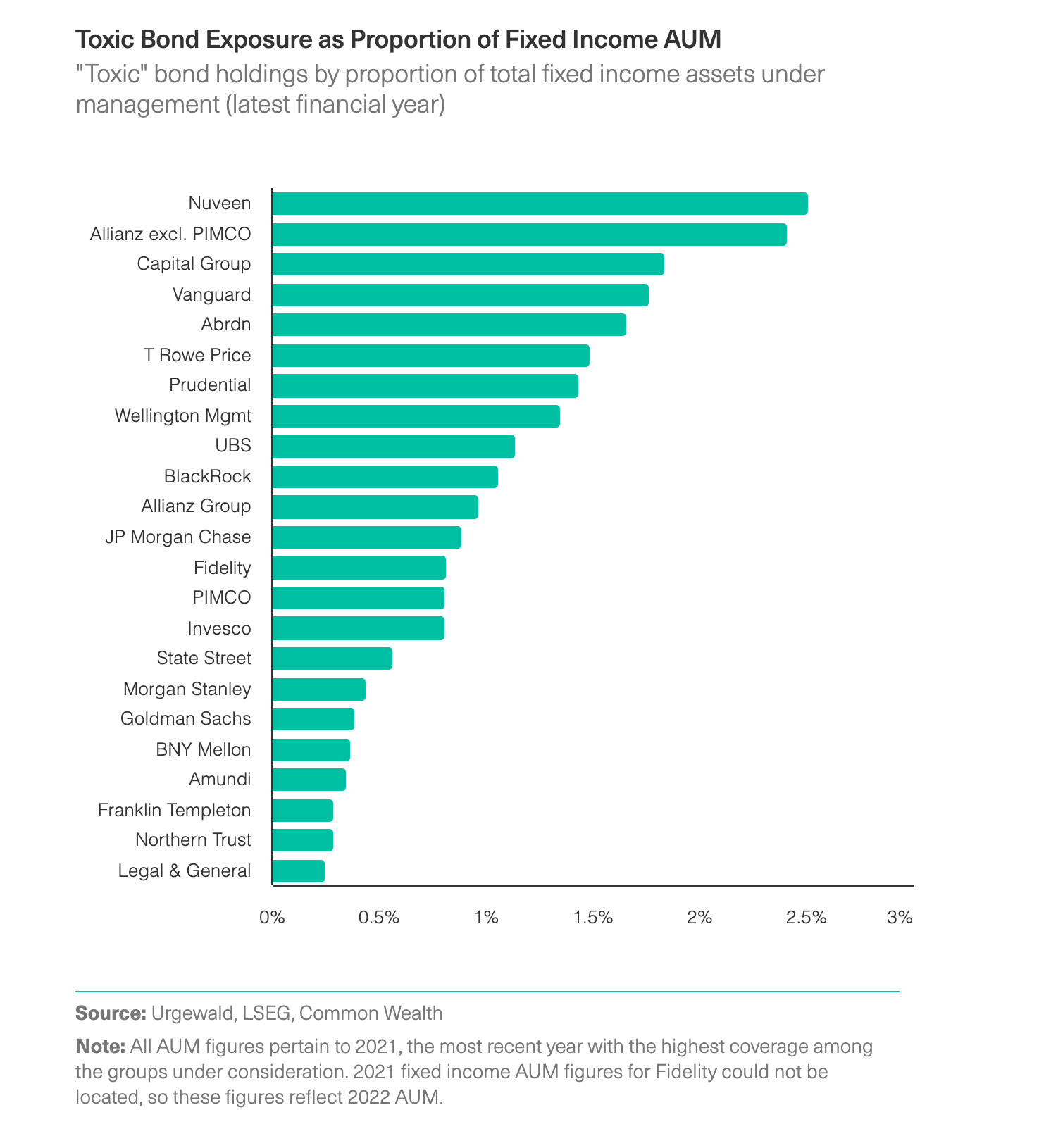

With respect to the proportion of their bond portfolios invested in fossil fuel or ‘toxic’ bonds, the top five investors are Nuveen (2.51%), Allianz excl. PIMCO (2.41%), Capital Group (1.84%), Vanguard (1.77%) and Abrdn (1.66%).

The analysis found that fossil fuel firms have issued $1.9 trillion worth of corporate bonds since the Paris Agreement. This marks an 188% increase in the overall total since the agreement came into force in November 2016.

The analysis found that fossil fuel firms have issued $1.9 trillion worth of corporate bonds since the Paris Agreement. This marks an 188% increase in the overall total since the agreement came into force in November 2016.

“The stark reality is that investors are providing a lifeline to coal, oil and gas companies, fueling their expansion through the loosely-regulated bond market. Vanguard, BlackRock, PIMCO, TIAA, and abrdn consistently rank as top bondholders in these companies, and regrettably, they have all failed to adopt policies that exclude fossil fuel investments. It’s high time for asset managers to halt their complicity in climate destruction and unequivocally deny debt to bonds issued by coal, oil and gas expansionists.”

– Camilla Schramek, Coordinator of the Toxic Bonds Network

“Corporate bond markets provide the oxygen coal, oil and gas companies need to sustain their climate damaging operations. Our findings show that huge asset management companies and other institutional investors have poured money into bonds that mature beyond 2030 and other key climate targets, locking us into a future that could blow past the globally agreed limit of 1.5 degrees of warming. Asset management firms are becoming the funders of last resort for the fossil fuel industry and a critical barrier to a clean energy transition.”

– Sophie Flinders, Data Analyst at Common Wealth

Corporate bonds are a critical source of funding for fossil fuel companies seeking to expand their coal, oil and gas activities, with bonds making up more than half of all financing for the industry. This has doubled since 2010, with both loan financing and equity issuance shrinking as an asset class for global fossil fuel fundraising.

The growth in corporate bond issuance marks an important shift in how fossil fuel giants fund their activities. As the Toxic Bonds Network argue, this trend risks creating stranded financial assets and makes breaching the 1.5-degree target more likely.

A recent study in the journal Nature found that if decarbonisation targets are reached in line with the Paris Agreement, half of the world’s fossil fuel assets could become worthless or ‘stranded’ by 2036. The fact that investors continue to fund fossil fuel extraction through corporate bonds suggests that they are locking us into global temperature rises beyond the targets set by the Paris Agreement, while also generating major ‘stranded asset’ risk.

Previous analysis, published by Common Wealth, found ‘green’ ESG funds have invested over $1.5 billion in the bonds of top coal, oil and gas companies – calling these funds’ sustainability claims into question.