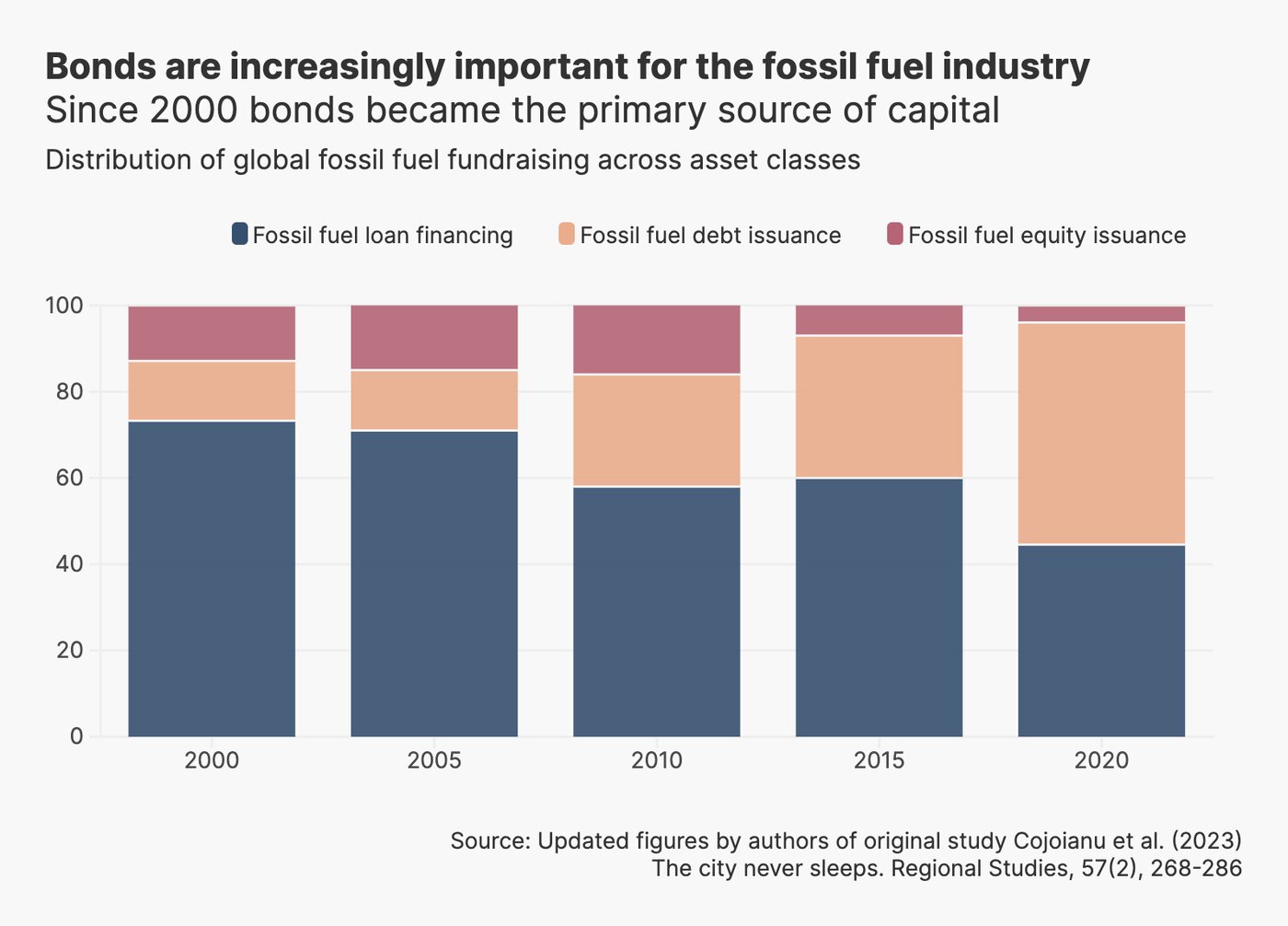

Corporate bonds are a critical source of finance for coal, oil and gas companies. Yet, compared to the stock market, the bond market has been overlooked. As a result, the fossil fuel industry has issued bonds to obtain backdoor funding for expansion.

Bond Issuers: Fossil Fuel Companies

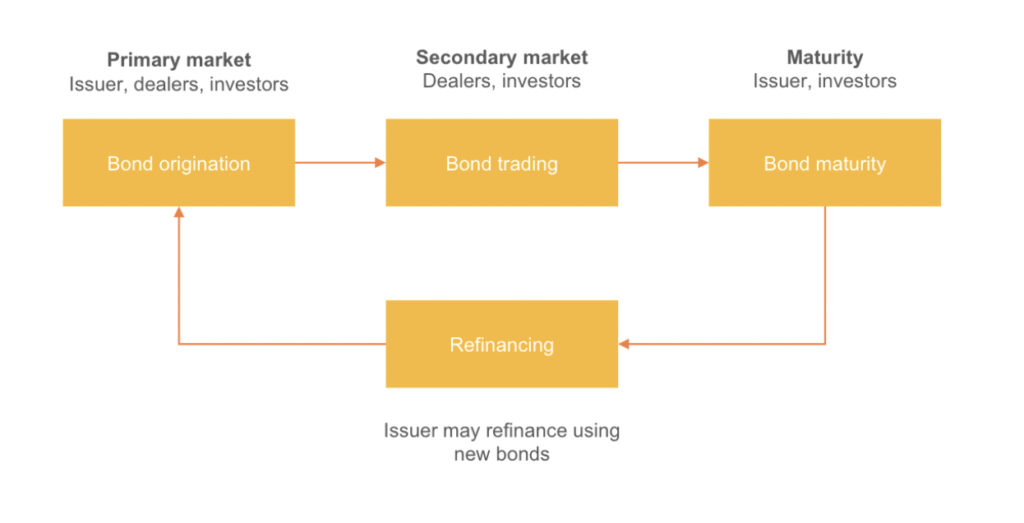

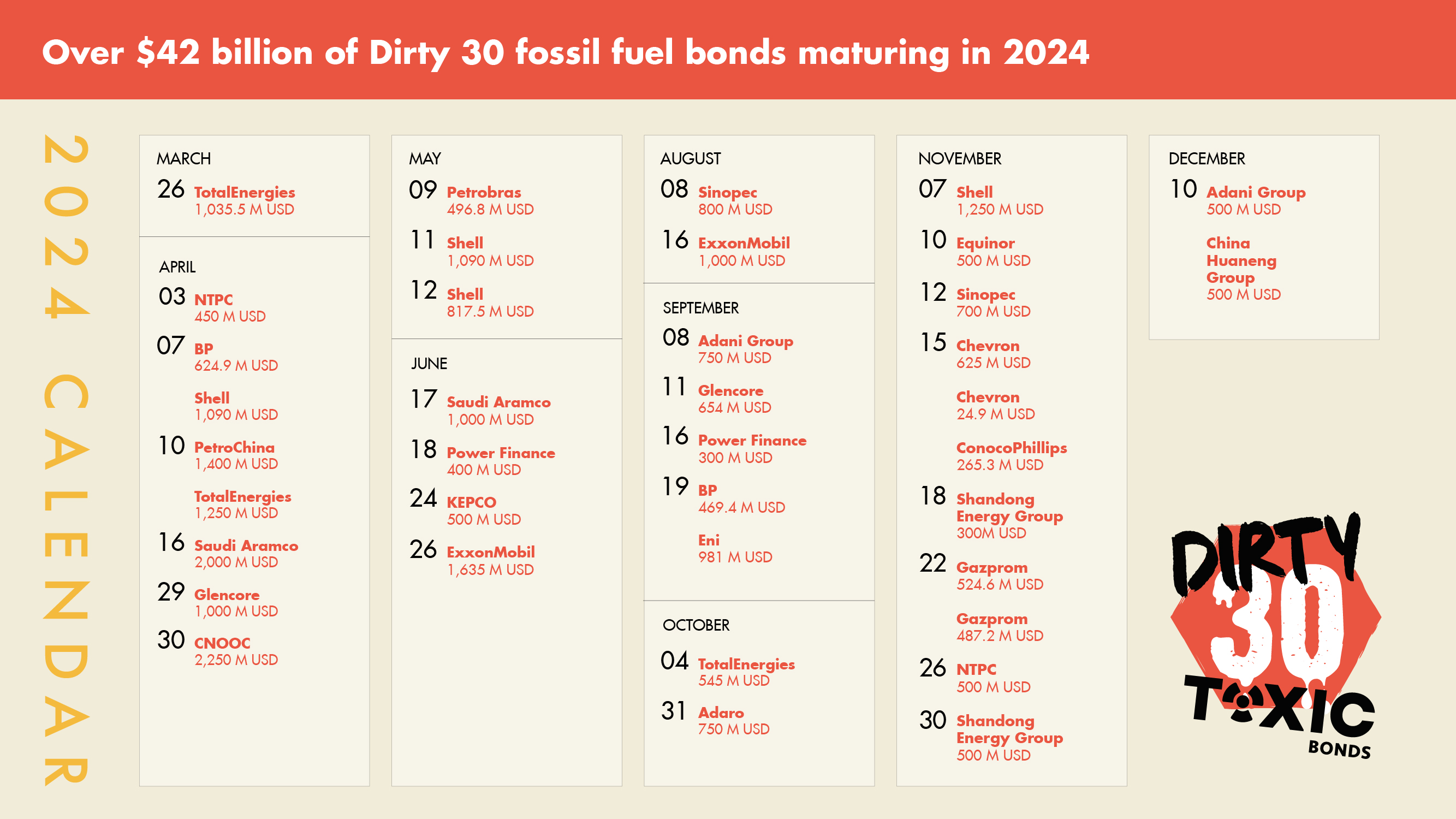

Companies issue bonds to borrow money for general operations, capital intensive projects, and refinancing other debt. Issuing bonds is attractive to fossil fuel and other carbon intensive companies because: they offer less scrutiny than loans (direct project financing); they can borrow large sums of money at cheaper rates than loans; they don’t have to hand over any control (equity) of the company to investors. The Dirty 30 are thirty of the worst fossil fuel companies in the world that are issuing bonds to fund coal, oil and gas expansion.

Bondholders: Investors

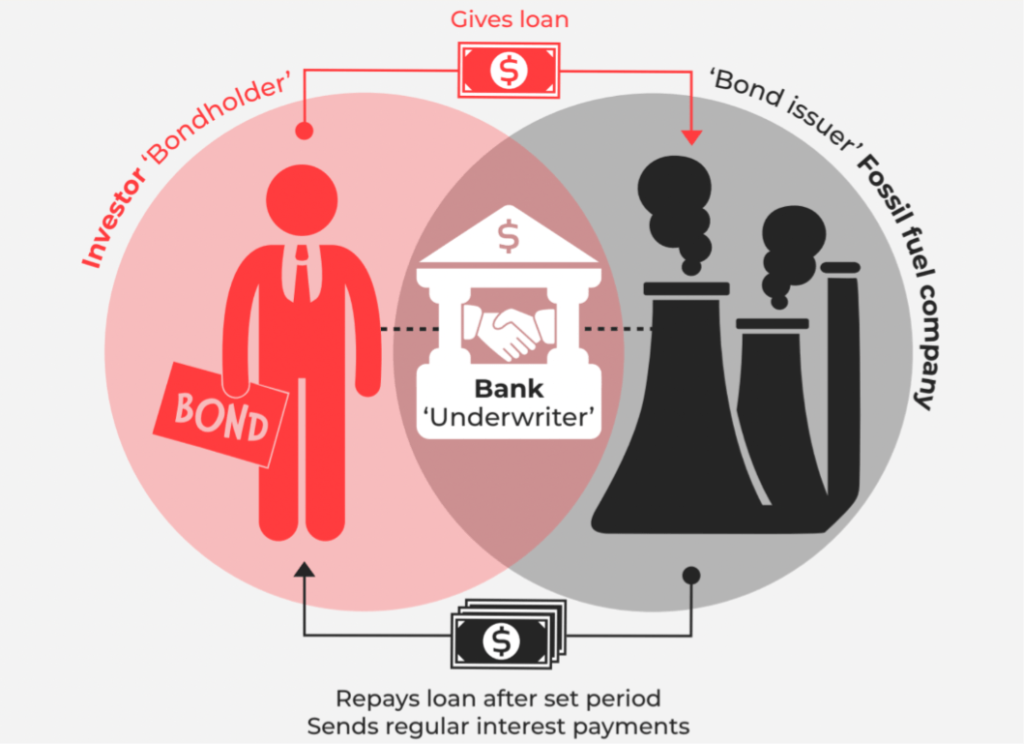

When an investor purchases a bond from a fossil fuel company they are lending it capital to fund its activities. The majority of investors or bond holders are asset managers or asset owners (primarily pension funds and life insurers).

Bond Underwriters: Banks

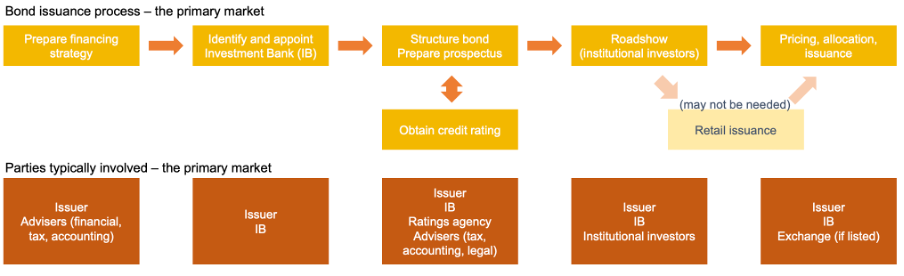

Acting as a underwriter (also known as an arranger or facilitator), investment banks manage all aspects of the bond issuance process, in particular they advise companies issuing bonds and help market bonds to investors. Fossil fuel companies rely on banks’ credibility to gain access to potential investors. Underwriting bond issuance allows banks to profit without risk being carried on the books (as a private loan would). Instead the risk is passed on to the bondholders.

Credit Rating Agencies

For a bond to be issued, the credit worthiness of the issuer needs to be rated. Three credit rating agencies (CRAs) dominate 95% of the credit rating business – S&P, Moody’s and Fitch. They tell potential investors how risky a bond is. The lower they deem the risk, the cheaper and easier it becomes for companies to secure debt. Though they claim these ratings are independent, CRAs are paid by the same companies they rate. Despite the risks from investing in fossil fuel projects, all three agencies stress do not typically downgrade the ratings of firms with strong balance sheets based on environmental, social and governance (ESG) issues alone.

FAQ

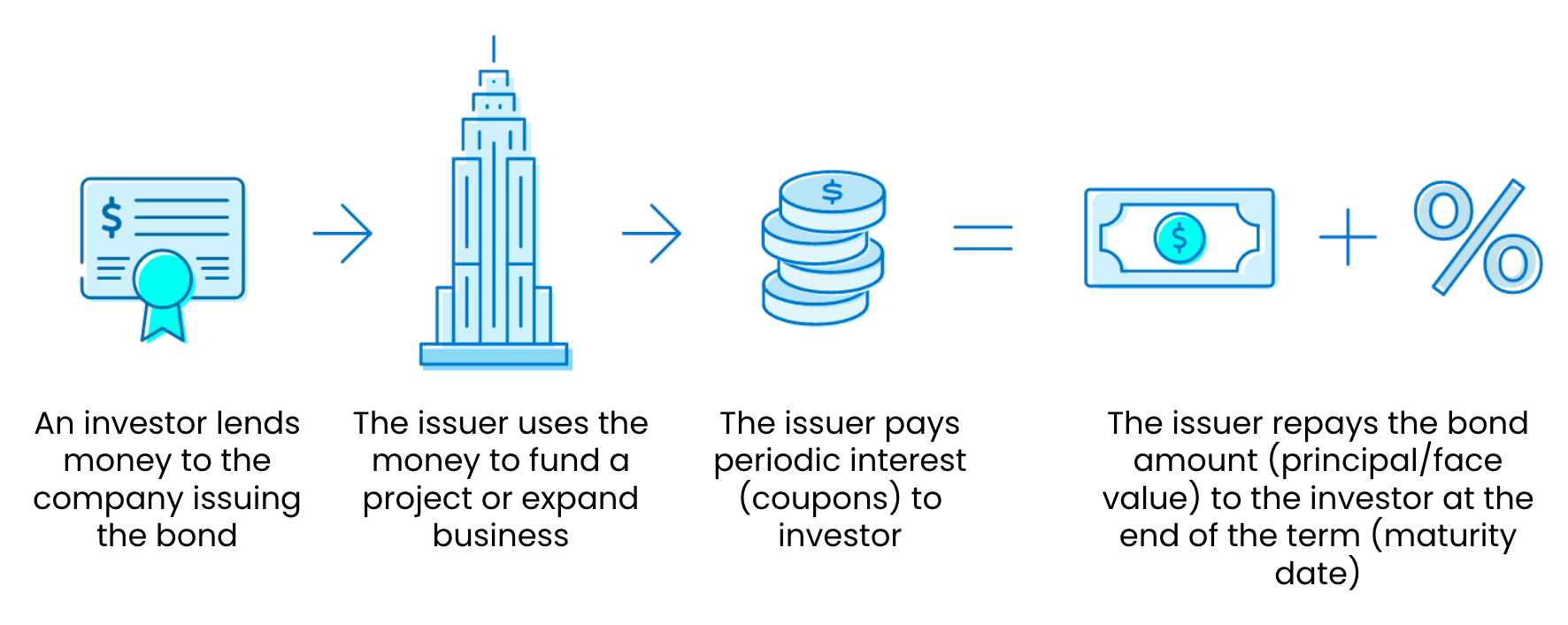

Bonds are a debt security, like an IOU, where a corporation, government or other entity (bond issuer) sells the bond to many investors (bondholders) which lend money to the entity for a set period of time (maturity period) in exchange for regular interest payments (coupon rate). After the maturity period, the principal (also known as face value or par value) is repaid to the bondholder.

When a company wants to raise money they have two choices: equity financing or debt financing. Equity financing means giving up a percentage of ownership in the company by selling shares. Debt financing means companies have to pay back the funds over an agreed time period, plus interest. Companies pursuing debt financing can choose one of two routes: a loan from a bank or other financial institution, or by issuing bonds.

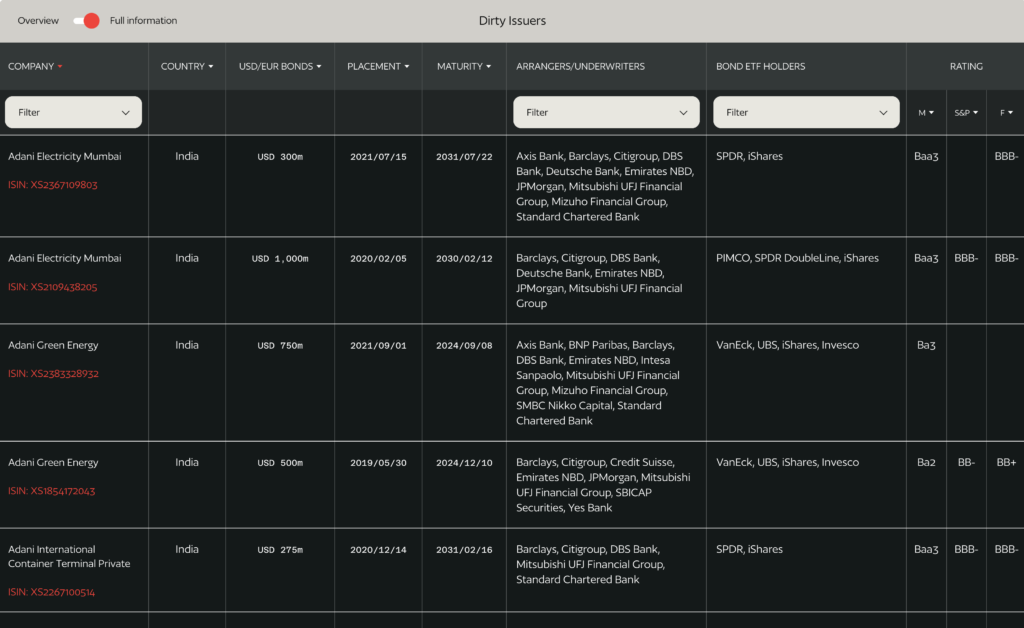

The Dirty 30

Learn about the 30 worst companies issuing bonds to finance their coal, oil and gas expansion