A new report by the Anthropocene Fixed Income Institute (AFII) finds that average maturity of large oil & gas producers’ debt has nearly doubled in recent years, extending investors’ exposure to these businesses at a time when their long-term viability is most in question.

What are long-dated bonds and why are they risky?

Long-dated bonds are bonds that companies issue with a maturity date far into the future, often 20 years or more. These bonds promise to pay investors regular interest over a long period. However, as governments implement efforts to decarbonise, there is a high chance that many fossil fuel assets — like oil wells, coal mines, and power plants — will become obsolete or worthless. If global net-zero targets are achieved, studies find that half of the world’s fossil fuel assets could become stranded by 2036.

This means that investors buying fossil fuel bonds that mature well beyond key global climate commitment deadlines, are exposing themselves to significant financial risk. It also means that investors buying these bonds believe one of two things:

- Fossil fuel companies will transition effectively away from fossil fuels… OR

- Coal, oil and gas assets will not become worthless, but continue to be profitable well past agreed phase-out dates.

Findings

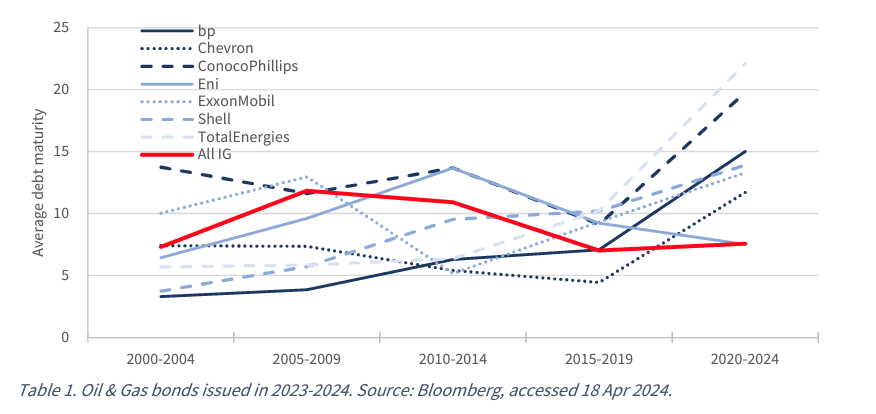

Major oil companies are issuing bonds with much longer maturities than before. The analysis looked at the average maturity dates of BP, Chevron, ConocoPhillips, Eni, ExxonMobil, Shell and TotalEnergies. All of the oil companies except Eni had an average bond maturity of well over 10 years despite the market average being 7.6 years. For example, TotalEnergies has increased the average maturity of its bonds from 5.7 years to 22.1 years since 2000, and BP has increased from 3.3 to 15 years.

Fossil fuel companies are making unrealistic predictions about future oil and gas demand. For example, Equinor expects a high price for Brent crude in 2050, much higher than the International Energy Agency’s forecast. These unrealistic expectations are leading companies to issue more long-dated and hybrid bonds to fund ongoing production, despite the likely decline in demand.

The bond market is not currently reflecting these risks in the pricing of long-dated oil bonds. The bond spread curves for companies like Shell and ConocoPhillips do not show significant changes, indicating that investors might not be fully aware of the potential pitfalls.