Today, Urgewald and partners, including the Toxic Bonds Network, released the 2024 edition of Investing in Climate Chaos, a website that reveals the fossil fuel bond and share holdings of over 7,500 institutional investors worldwide. The investment data was retrieved in May 2024 and shows that institutional investors currently hold $4.3 trillion in bonds and shares of fossil fuel companies. These investments are held by pension funds, insurance companies, asset managers, hedge funds, sovereign wealth funds, endowment funds and asset management arms of commercial banks.

The NGOs’ research covers institutional investors’ holdings in companies featured on Urgewald’s Global Coal Exit List (GCEL) and Global Oil & Gas Exit List (GOGEL). GCEL and GOGEL are public databases that provide detailed information on 2,928 companies operating in the fossil fuel sector. 2,048 of these companies are fossil fuel developers. They are exploring or developing new hydrocarbon reserves or planning to build new fossil fuel infrastructure such as pipelines, LNG terminals or coal- and gas-fired power plants. According to the data, almost $4 trillion of the identified institutional investments are in companies which are actively developing new fossil fuel assets.

A deep dive into the fossil fuel bond holders and issuers

Investing in Climate Chaos finds that institutional investors are holding almost $581 billion in bonds issued by coal, oil and gas companies. But we know this is a vast underestimate. Coverage of investments in bonds is far from complete, with figures only estimated to represent between 20% and 30%.

The world’s 5 biggest bondholders in fossil fuel companies include Vanguard, Blackrock, Minnesota State Board of Investment (MSBI), Allianz (including PIMCO) and the Korea National Pension Service, respectively.

The fourth biggest fossil fuel bondholder is Allianz, with over $18 billion invested in fossil fuel bonds. Despite its insurance arms’ climate leadership and its self proclaimed promise that “every investment is checked for sustainability”, Allianz is demonstrating significant climate hypocrisy via its asset management arms PIMCO and Allianz Global Investors. Allianz’s insurance arm is the most ambitious in its exclusion of fossil fuel projects – ranked highest in underwriting in Insure Our Future’s annual insurance scorecard. Meanwhile, its investments arms PIMCO and Allianz Global Investors have not implemented these same standards, and PIMCO has walked away from Climate Action 100+.

Allianz & PIMCO have the highest exposure to fossil fuel bond holdings as a proportion of its assets under management (2.27%) compared to the world’s top asset managers. They also continue to invest millions in bonds issued by Adani Group (7th largest bondholder) and TotalEnergies despite Allianz’s exclusion of insurance for controversial projects like Adani Group’s Carmichael coal mine and TotalEnergies’s East Africa Crude Oil Pipeline (EACOP). The greatest portion of Allianz’s coal, oil and gas bonds are invested in PEMEX ($1.8 billion), Venture Global ($1.5 billion) and Enel ($1.1 billion)

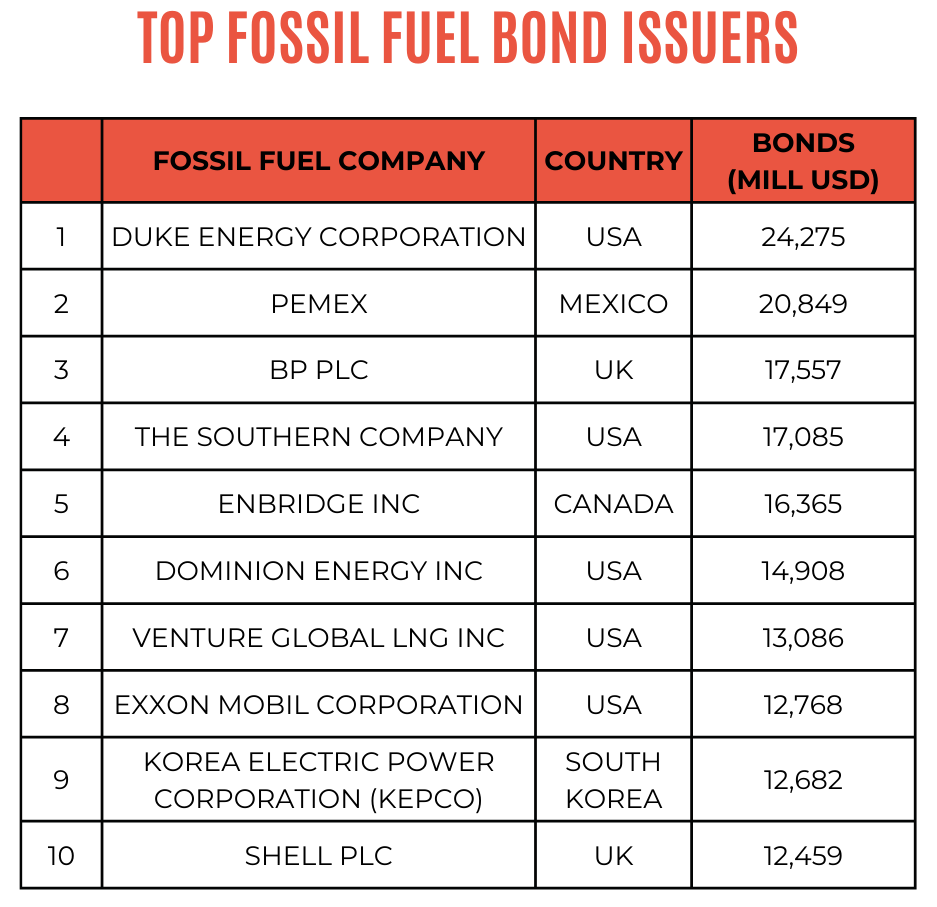

Which fossil fuel companies top the list?

The top 10 companies with the most outstanding fossil fuel bonds have over $162 billion on the market, making up 27% of all bond issuance.

Pemex (Petroleos Mexicanos), the second biggest bond issuer on the list, is a Mexican state owned oil company that specialises in extra heavy oil and offshore extraction projects (and is renowned for provoking offshore fires). PEMEX is the most indebted issuer on the Dirty 30 list with 61 outstanding USD and Euro bonds worth over $147 billion. The heavily indebted company is also entangled in multiple financial and environmental scandals, and has no climate strategy. Yet, it continues to secure funding, including the issuance of $54 billion in bonds since 2020. Amongst the top investors in PEMEX’s bonds are Allianz, Fidelity Investments and the California Public Employees’ Retirement System (CalPERS).

A Trillion-Strong Tidal Wave or a Turning Point?

According to the London Stock Exchange Group around $3.2 trillion in outstanding debt of high-carbon companies is coming up for refinancing in the coming years. Amongst the outstanding bonds issued by just the Dirty 30 – the 30 worst companies issued bonds to fund their fossil fuel expansion – over 50% worth over $325 billion will mature by 2030.

The question is, will investors continue snapping up bonds issued by companies like PEMEX, Adani, Saudi Aramco, ExxonMobil or TotalEnergies whose business model relies on destroying the planet? Or will pension funds, insurers and asset managers realise that these investments will produce more heat waves, more catastrophic floods, more climate disasters?

2024 is the year of climate finance. It was the number one topic at the UN climate meeting in Bonn in June, and it remains the biggest lift at COP29 in Baku this November. But climate finance remains a trickle in comparison to the tidal wave of trillions institutional investors could channel to the fossil fuel industry over the coming years.

“2024 needs to become the turning point, the year where central banks and regulators finally act on Article 2.1(c) of the Paris Agreement and take measures to ensure that financial flows are in line with Paris instead of pitted against it. Institutional investors need to start shifting the trillions to supercharge the energy transition and not fossil fuel expansion,” says Ganswindt.