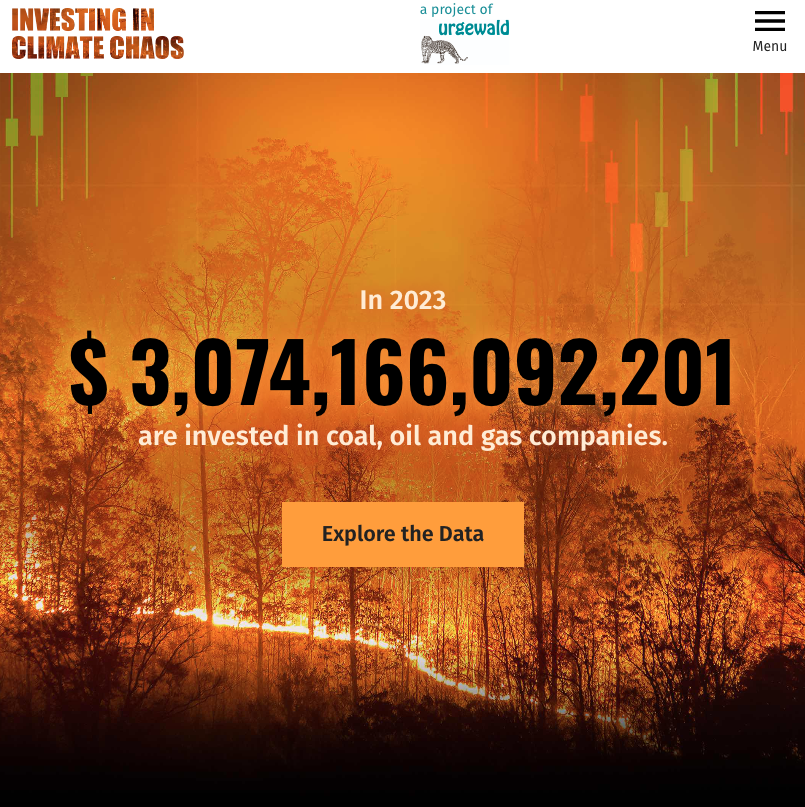

Investing in Climate Chaos reveals 6,500 institutional investors whose holdings in fossil fuel companies total US$ 3.07 trillion: $393.9 billion in bonds and $2.67 trillion in shares. The report is a joint project of Urgewald and 20 NGO partners, including the Toxic Bonds Network. It provides a detailed breakdown of each investor’s holdings in upstream oil and gas producers and companies operating along the thermal coal value chain.

Nearly all coal developers in the Global Coal Exit List (GCEL) have issued bonds to finance and develop their operations. But over 30% of the total bond holdings in fossil fuel companies are held by just 10 investors. Chief among them are Allianz ($10.9 bill), primarily via its fixed income arm PIMCO, and TIAA ($8.9 bill), pension provider for employees of academic institutions and non – profits. The top bond holders also include major asset managers Vanguard ($25.3 bill) and Blackrock ($20.9 bill).

Allianz has been praised by environmentalists for excluding coal facilities from its insurance products and reducing exposure to oil and gas. However, PIMCO, which manages 75% of Allianz’s assets under management, has failed to adopt Allianz’s strong standards. PIMCO’s commitment to buying bonds from companies expanding fossil fuels is an Allianz governance and leadership failure. This is reflected in Allianz’s fossil fuel bond holdings which are more than double ($10.9 bill) that of its equity investments ($5 bill).

In October, nearly 300 clients of the $1.2 trillion retirement giant TIAA filed a formal complaint with the UN-sponsored Principles for Responsible Investment (PRI) initiative, alleging TIAA’s substantial investments in fossil fuels and deforestation violate TIAA’s climate pledges and commitment to the six Principles for Responsible Investment. Recently exposed as one of Adani Group’s biggest bondholders, TIAA has not shied away from investing pensioners money in coal, oil and gas – even within a company exposed of “brazen stock manipulation and accounting fraud”.

“The overlooked role that the bond market plays in ratcheting up climate change can no longer be ignored. Investors like TIAA and Allianz, via PIMCO, are using the bond market as a back door to expand coal, oil and gas operations – dirty energy that brings us ever-closer to irreversible climate chaos. Investors need to cut off this lifeline to fossil fuel companies. Decarbonization is a matter not just of global security but long term investment security – and this explicitly means denying new debt to coal, oil and gas companies. Allianz, a frontrunner on climate action from its insurance arm, must now lead the charge with its assets under management and deny new debt to fossil fuel expansionists – or its climate pledges will ring hollow,” says Katrin Ganswindt, head of finance research at Urgewald.