Ahead of TotalEnergies’ Investor Day in New York on 2 October, a new briefing from Reclaim Finance reveals how banks and investors are financing increasingly long term bonds issued by the oil and gas major – allowing it to continue its fossil fuel expansion strategy up to 40 years.

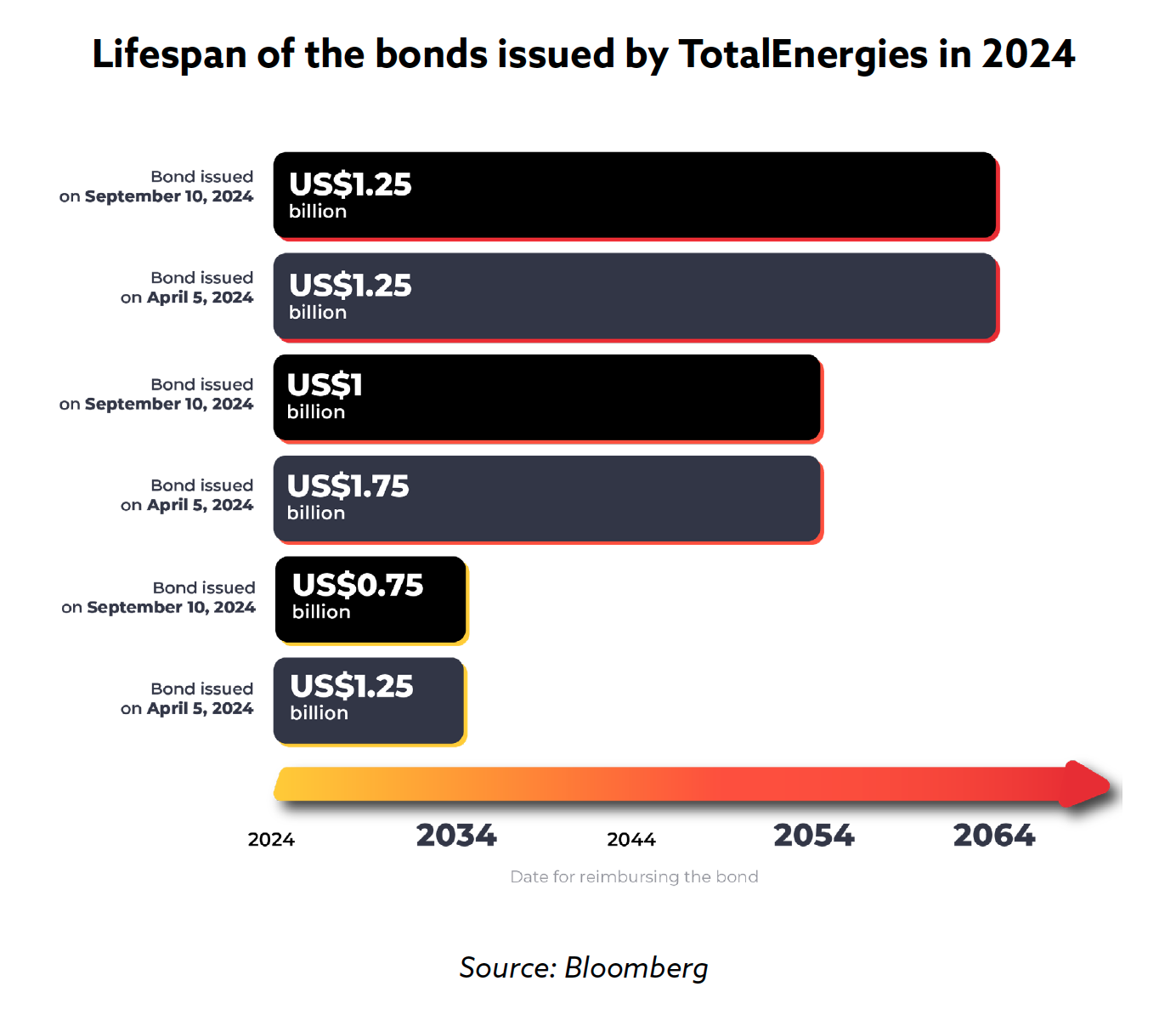

In the last 6 months, TotalEnergies has issued $7.25 billion in bonds with maturity dates up to 2064. But while this financing strategy is a win for TotalEnergies, it is a risky gamble for the banks and investors involved. Reclaim Finance urges financial players to stop participating in TotalEnergies’ new bonds and to urgently end their support for companies developing oil and gas projects.

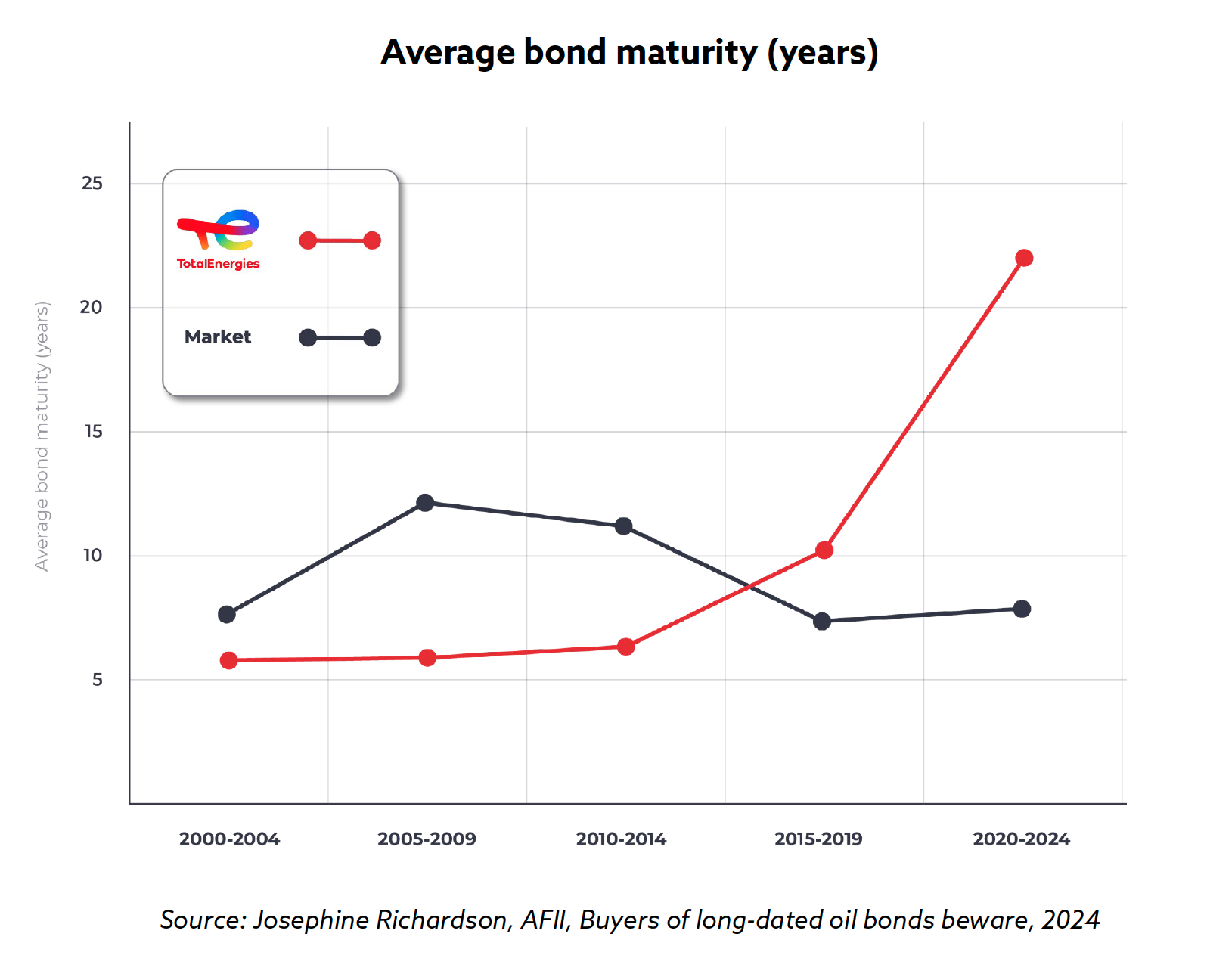

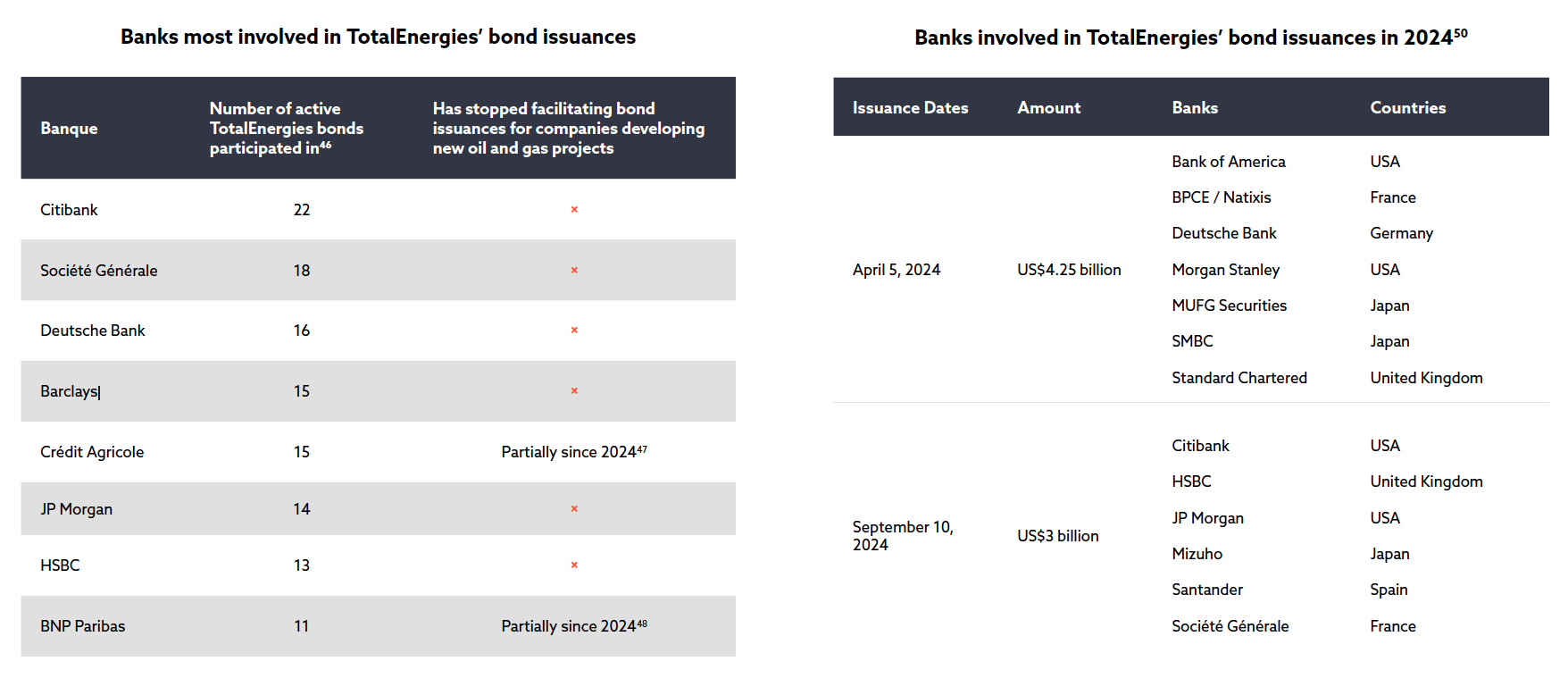

With US$3 billion raised in September 2024 and US$4.25 billion in April, TotalEnergies has successfully issued several bonds this year – with the help of a number of banks, including HSBC, Citi, Mizuho, Societe Generale and Deutsche Bank. These recent transactions illustrate the crucial role bonds play in TotalEnergies’ financing strategy. As the company’s main source of capital – almost 70% of the funds raised come from bonds. These bonds have increasingly long maturities with an average of 22 years between 2020 and 2024, compared with Total’s average maturity of 6 years between 2000 and 2004. The most recent bonds, for example, extend to 2064. By financing TotalEnergies over increasingly long periods and without any conditions on how funds are used, these financial institutions allow the company to pursue its climate- destructive strategy.

These long dated bonds are a gift for TotalEnergies. Banks and investors don’t have any say in how the money is used. However, the abnormally long maturities of the latest bonds should give financial institutions cause for alarm. The financial players provide the ideal conditions for TotalEnergies to carry out its fossil fuel expansion plans, allowing it to secure advantageous and fixed borrowing terms over a very long period. Such financing increases systemic climate-related risks – risks which are already jeopardising the future of the oil and gas sector, and therefore the value of its assets, which could turn into stranded assets. It is a risky gamble for investors in TotalEnergies’ bond issuances to rely on the company’s ability to repay over the very long term.

If investors are choosing to support TotalEnergies in the long term with full knowledge of the situation, it suggests they are betting on the failure of climate action and the regulations that would follow, all while publicly affirming their commitment to it.

On top of its April and September bond issuances, TotalEnergies’ has two more bonds reaching maturity this year, on 4 October and 16 December 2024, in which the company may seek to refinance this debt.

In May, BNP Paribas and Crédit Agricole announced that they would no longer participate in conventional bonds in the oil and gas sector. All banks must follow this lead, notably HSBC, Citigroup, Société Générale, and Deutsche Bank, and start by committing to stop facilitating any new bonds issued by TotalEnergies.

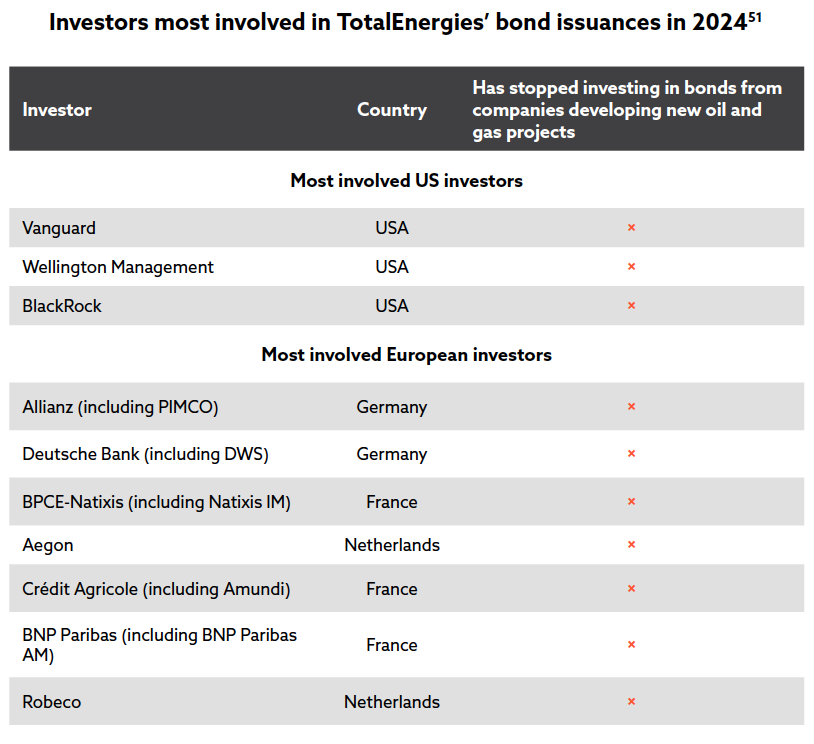

Reclaim Finance is also calling on investors that have purchased the April 2024 bond, including Allianz (and PIMCO), Deutsche Bank and the Government Pension Fund of Norway, to stop buying new TotalEnergies bonds. More generally, all financial players must end their support for companies developing new oil and gas projects.