This month marks the anniversary of the largest offshore oil spill in history. Fourteen years since BP covered our coastlines and wildlife in toxic oil. Fourteen years since 130 million gallons of oil leaked across the Gulf and left lasting impacts on the wildlife, public health, and economies throughout the region.

Fourteen years and communities still haven’t fully recovered. Pat Morgan, a resident of Texas, still sees balls of oil wash up on Texas beaches. And Craig Nazor, who works in conservation, is concerned that funding is running out to preserve endangered sea turtles that were affected by the BP spill. Their stories are not unique: the oil spill continues to take a toll on local communities and wildlife, who are anxious about whether there will be another spill just around the corner.

Despite the lasting damage, BP not only continues to drill, but to build out new and unnecessary drilling projects. In spring of last year, for example, BP started operating a new offshore drilling platform – Argos – in the Gulf that will increase the company’s total production in the region by 54%; the platform is expected to produce 140,000 barrels of oil a day, enough to move over 170,000 mid-sized cars from NYC to DC every day.

While it’s been fourteen years since BP’s Deepwater Horizon oil spill, BP continues to make headlines for environmental disasters: spills of toxic pollutants into the air and water from in a refinery in Indiana and violating coastal protections in Cameron Paris, Louisiana.

We can’t trust BP – or any other fossil fuel company – to take care of the Gulf or our communities.

BP puts their profits before our communities, which means that as long as BP continues to have access to new funding it will continue on its path of climate destruction. To protect our Gulf, we have to stop the funding of fossil fuel expansion. And that starts with holding financial companies accountable.

BP’s bonds

One of the biggest ways that fossil fuel companies, like BP, raise money is by selling bonds. BP has 52 bonds on the market worth over $57 billion. The biggest buyers of these bonds are asset managers – large institutional investors responsible for handling your retirement savings. These asset managers, such as Vanguard and Blackrock, oversee investments and retirement savings for individual investors, corporate 401(k)s, foundations, public pension funds, and more. Asset managers use the money from retirement accounts, pension funds, and individuals’ investments – in other words, your savings – to make investments in companies harming the planet.

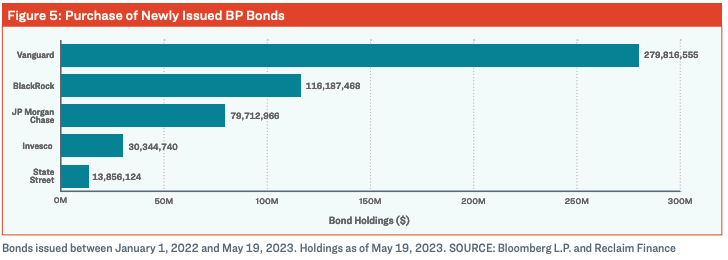

While thousands of investors buy these bonds, a small handful of asset managers purchase the vast majority.

Five of BP’s biggest bondholders are based in the US: BlackRock, StateStreet, Vanguard, JPMorgan Asset Management, and Invesco. In less than 2 years, these 5 asset managers funneled over $520 million to BP alone. And that’s on top of the hundreds of millions of dollars they’ve also invested in other companies drilling and refining in the Gulf and wreaking havoc on Gulf communities.

For too long, the health, well being, and prosperity of communities impacted by BP’s fossil fuel expansion, like those in the Gulf, have been sacrificed to satisfy BP’s corporate greed.

For this to stop, we need to stop funding companies like BP that continue to put profit over people and the planet.

To do that, we need to demand that asset managers deny debt to BP.

Originally written by Jessye Waxman, Senior Campaign Strategist in the Sierra Club’s fossil free finance campaign.