A new report by the Sierra Club’s Fossil-Free Finance campaign reveals how five major asset managers BlackRock, Vanguard, JPMorgan Asset Management, State Street Global Advisors, and Invesco are putting peoples’ investments and retirement savings at risk by using their money to finance fossil fuel projects and fuel the climate crisis. These asset managers collectively manage more than $25 trillion on behalf of their clients — which is more than the GDP of the entire United States — including holding $741 billion in shares and bonds of fossil fuel companies.

The analysis details the growing role of bond financing in propping up fossil fuel companies like ConocoPhillips, BP, EQT Corporation, TotalEnergies, and Pioneer Natural Resources, which are behind several controversial fossil fuel expansion projects in the U.S. including the Willow Project, deepwater oil drilling, the Mountain Valley Pipeline, LNG exports, and Permian Basin drilling. These fossil fuel projects would not be possible without the purchase of bonds by investors. From a financial standpoint, these projects are bad climate decisions and dangerous investments at risk of becoming stranded – or worthless – assets. They also contribute to the systemic financial risk of climate change.

“Climate change is one of the biggest emerging risks to the economy and financial markets, but most of the world’s largest asset managers seem to be ignoring this fact. They continue to buy bonds in companies engaging in fossil fuel expansion, thereby enabling the very activities that exacerbate risk for their clients’ portfolios. Portfolio and retirement fund managers risk violating their fiduciary duties in failing to adopt strategies that mitigate climate change and its impacts on financial markets,”

– Jessye Waxman, Senior Strategist in the Sierra Club’s Fossil-Free Finance campaign and author of the report

The report reveals that over the course of just 17 months, from January 2022 to May 2023, these five asset managers alone spent $1.6 billion purchasing new bonds to support these fossil fuel companies: ConocoPhillips ($715 million), BP ($520 million), EQT Corporation ($140 million), TotalEnergies ($108 million), Pioneer Natural Resources ($157 million).

This financing comes despite the fact that these major asset managers have made public climate commitments and signed on to the Net Zero Asset Managers (NZAM) initiative — although Vanguard later dropped out. NZAM is an industry-led initiative with a goal of supporting investing aligned with net-zero emissions by 2050.

The growing role of bond financing

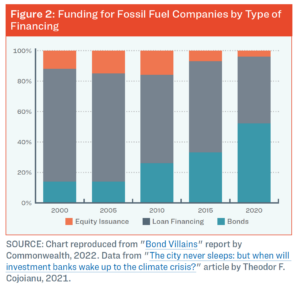

Fossil fuel companies raise most of their money from four sources: the sale of fossil fuels, loans they get from banks, the sale of bonds to investors, and the sale of new shares to investors. Over the past two decades, bond sales have constituted a growing share of the financing for fossil fuel companies, growing from 14% of total fossil fuel financing in 2000 to 52% in 2020. The investors purchasing these bonds are typically large institutional investors like asset managers and pension funds.

Fossil fuel expansion, like the Willow Project or the Rio Grande LNG terminal, can’t happen without the help of the money that is raised through the sale of bonds. And bond sales can’t be successful without investors, including the world’s largest asset managers, agreeing to buy them. When asset managers continue to purchase newly issued bonds, it tells fossil fuel companies that investors approve of their current plans and support a longer future for fossil fuels — which enables companies to continue expanding unsustainably instead of prioritizing decarbonization and phasing out fossil fuels. This funding, therefore, helps create a vicious feedback loop that ends in climate destruction: new money to fossil fuel companies makes expansion projects possible, which locks us into continued use of fossil fuels as a society. This, in turn, makes investors more confident that fossil fuels are a safe, long-term investment, and the cycle continues. But we can — and must — break the cycle.

Asset managers need to understand the risks fossil fuel expansion poses not just to society, but to their investments and clients as well. If asset managers are serious about helping companies adjust and succeed in the clean energy transition and about reducing the many climate risks that society and their own clients face, they must stop buying bonds from companies undertaking new fossil fuel expansion. To put asset managers on the right track, we must demand that they stop funding fossil fuels.