Reclaim Finance has identified the investors who participated in TotalEnergies’ latest bond, a US$4.25 billion bond issued in April 2024. Among them are the American asset managers, BlackRock and Vanguard, and the French banks, BNP Paribas and Crédit Agricole. By agreeing to lend money to TotalEnergies on a very long term basis (until 2064), these investors are not only enabling the oil & gas major to finance its devastating projects, but are also actively betting against the energy transition, as TotalEnergies’ current strategy does not allow it to follow a realistic trajectory to limit global warming to 1.5°C.

Bonds are TotalEnergies’ primary source of financing, allowing it to finance the development of new oil and gas projects, which are incompatible with limiting global warming to 1.5°C. These transactions are increasingly criticised, in a context where some banks, notably BNP Paribas and Credit Agricole in France, have pledged to stop directly financing TotalEnergies’ controversial projects such as EACOP and Papua LNG.

The investors in TotalEnergies’ latest bonds

This three-bond issue, completed on April 5, 2024, is the company’s largest since 2019. Seven banks – Bank of America, Deutsche Bank, Morgan Stanley, MUFG, Natixis, SMBC Nikko, Standard Chartered – have enabled TotalEnergies to raise $4.25 billion from investors.

According to the limited information disclosed on the Bloomberg terminal (extracted 19 July, 2024), at least 80 investors contributed to raising the requested amount, including 3 French investors, Crédit Agricole (via its subsidiary Amundi), BNP Paribas and BPCE Groupe/Natixis. The amount raised is dedicated to “general corporate purposes” and can be used by TotalEnergies as the company sees fit, such as its plans to develop new oil and gas projects in 53 countries, including Mozambique, Papua New Guinea and South Africa.

- The asset managers with the largest investments are Vanguard, BlackRock and Capital Group (more than $394 million in total).

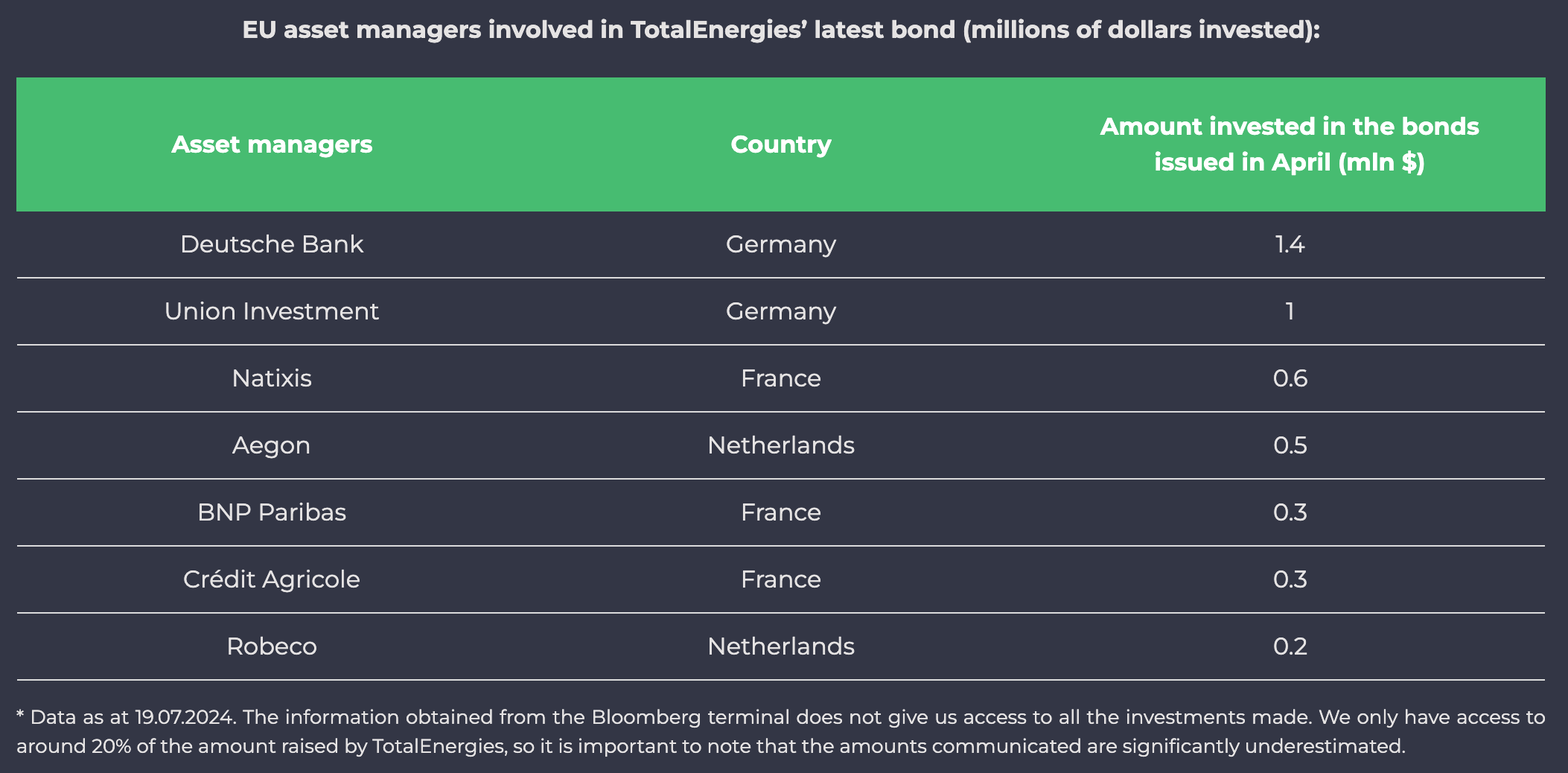

- In the European Union, TotalEnergies’ investors for this deal are Germany’s Deutsche Bank and Union Investment, France’s BPCE Groupe/Natixis, BNP Paribas and Crédit Agricole/Amundi, and the Netherlands’ Aegon and Robeco.

Investors give TotalEnergies financing for decades to come

Bonds account for 70% of TotalEnergies’ financing sources between 2016 and 2023. While banks assist the company in issuing the bond, it is investors who purchase the bonds, providing TotalEnergies with fresh capital. These new bondholders are turning a blind eye to the need to end support for fossil fuel expansion and sanction companies that pursue activities incompatible with limiting global warming to 1.5°C. TotalEnergies falls into this category, as the public company developing the most new oil and gas production projects in the world. Every investor involved in this transaction is therefore contributing to worsening the climate crisis.

Worse still, a study by the Anthropocene Fixed Income Institute, based on Bloomberg data, shows that TotalEnergies is issuing bonds with increasingly longer maturities. The average maturity of TotalEnergies bonds was 22 years between 2020 and 2024, compared with 6 years between 2000 and 2004 (the average maturity remained stable over the same period for the market as a whole).

The fact that investors are agreeing to lend money to the oil and gas major for ever longer periods, without blinking an eye, even though the oil and gas sector is doomed to decline, raises serious questions about the financial market’s ability to take climate risk into account.

But this trend also reveals that investors in TotalEnergies’ bonds are actively betting against the transition from fossil fuels to clean energy.

Indeed, they have agreed to lend money until 2064, without imposing any conditions regarding the company’s climate strategy, which is far from being 1.5°C aligned.

Double standards?

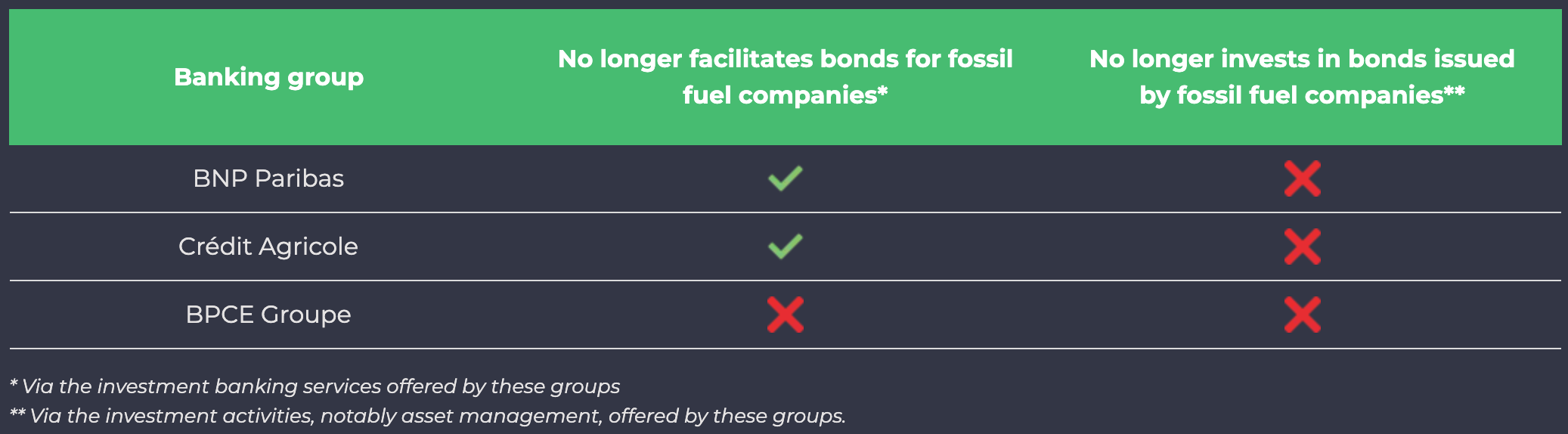

The presence of subsidiaries of some of the banking groups among the investors also raises questions. While Crédit Agricole and BNP Paribas have refused to underwrite TotalEnergies’ bond issuances, Amundi, Crédit Agricole’s asset management subsidiary, and BNP Paribas AM, a subsidiary of BNP Paribas, are among the investors in these same bonds.

This inconsistency begs the question: if you are refusing to help structure these financial products because they contribute to climate change, why continue to invest in them? The argument that these subsidiaries, as asset managers, invest on behalf of their customers and therefore cannot adopt such restrictions, does not hold. Both subsidiaries have had coal restrictions in place for several years.

It is to be hoped that the enthusiasm for TotalEnergies’ future bonds will be less strong and will draw a line between responsible investors and others. BNP Paribas, Crédit Agricole, BPCE Groupe and their peers must urgently commit to no longer invest in new bonds that ignore the conclusions of the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA). BPCE Groupe/Natixis must also urgently make strong commitments for its banking activities.