Wall Street banks quietly raise billions for polluting companies through underwriting activities

A new report by the Sierra Club’s Fossil-Free Finance campaign on the role of big US banks in capital markets reveals a hidden pipeline for fossil fuel financing through the banks’ underwriting of bonds and equities for polluting companies. The analysis raises important questions about how the 6 biggest US banks calculate and report on their facilitated emissions, and makes the case for the importance of banks’ capital markets activities in achieving real-world emissions reductions.

The report comes ahead of the imminent release of an updated methodology on how banks can disclose and set targets for their facilitated emissions by the industry-led initiative Partnership for Carbon Accounting Financials (PCAF).

“The reality is, without banks, fossil fuel companies cannot raise money through capital markets. By downplaying their role in capital markets and refusing to include facilitated emissions in their climate targets, big US banks are intentionally sidestepping a major source of real-world emissions and making it impossible to meet their own net-zero commitments.”

– Adele Shraiman, Senior Campaign Strategist with the Sierra Club’s Fossil-Free finance campaign

Toplines from the report

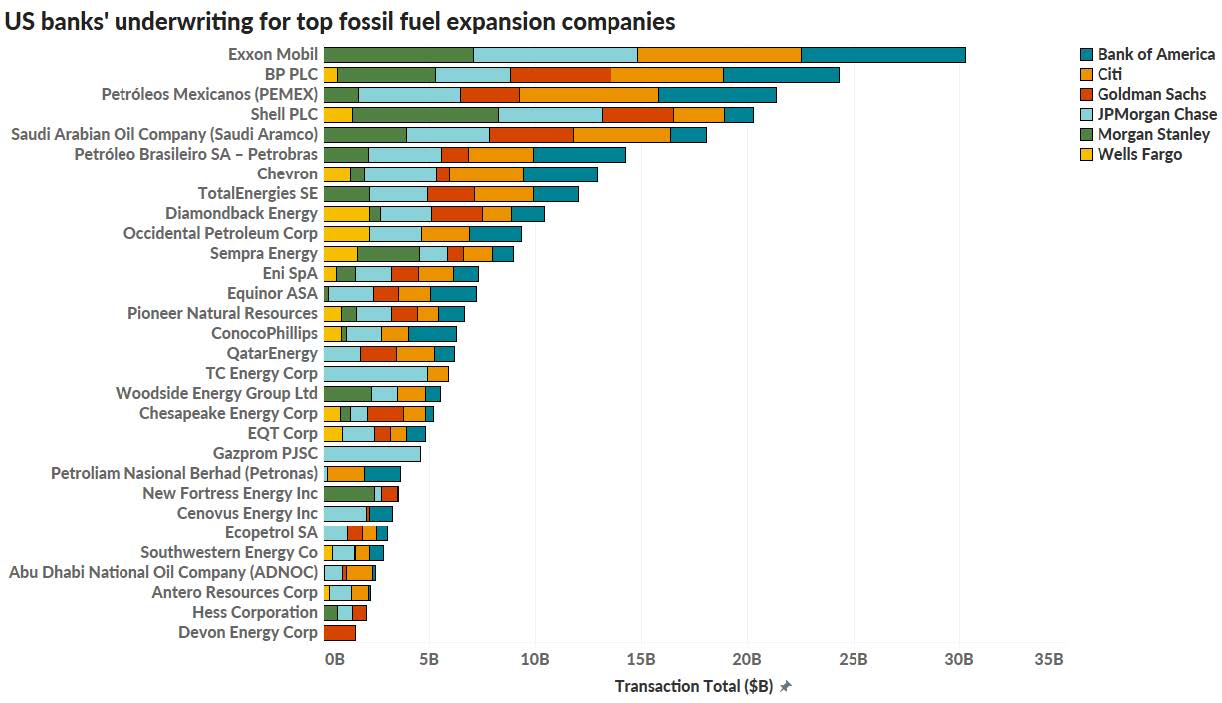

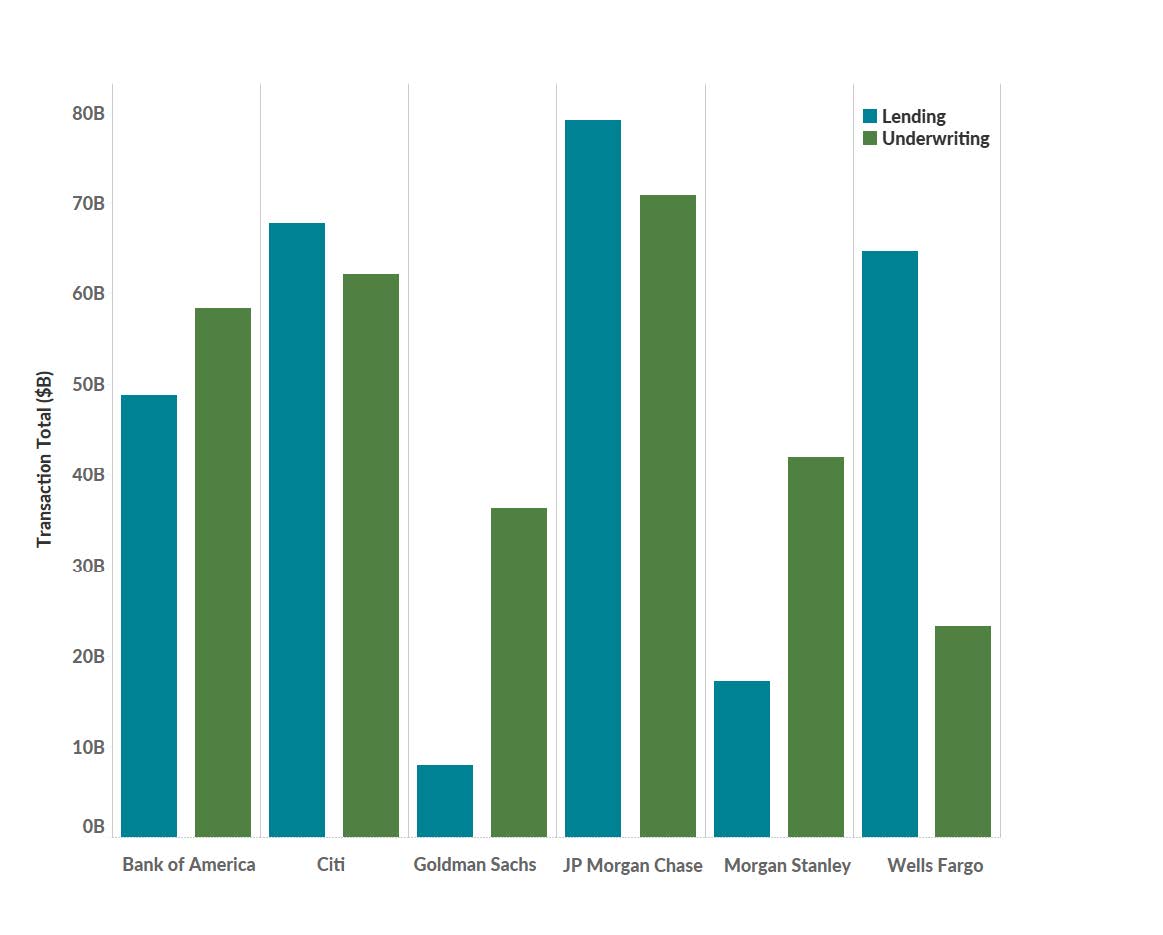

The analysis, which uses data from the annual Banking on Climate Chaos report, examines the capital markets activities of the 6 biggest US banks for 30 of the top fossil fuel expansion companies in the world. It reveals that from 2016-2022, nearly two thirds (61%) of the financing for fossil fuel expansion companies from JPMorgan Chase, Citi, Bank of America, Wells Fargo, Morgan Stanley, and Goldman Sachs was via capital markets, as opposed to direct lending.

From 2016-2022, these six banks have underwritten $266 billion in new bond and equity issuances for top fossil fuel companies. JPMorgan Chase was the largest underwriter, providing $69.9 billion in underwriting of bonds and equities. Citi was the second largest underwriter.

The analysis also reveals the variations in the breakdown of banks’ lending versus underwriting activities from 2016-2022. Underwriting far outpaced lending for Morgan Stanley and Goldman Sachs; lending and underwriting were closer to equal for Bank of America, Citi, and JPMorgan Chase; and lending far outpaced underwriting for Wells Fargo.

Misleading net-zero plans

Despite the importance of capital markets in helping fossil fuel companies secure funding, the report shows how banks focus on lending, and downplay underwriting, when setting emissions reduction targets. Essentially, banks are distracting investors and regulators with half-finished net-zero transition plans, while funneling money to fossil fuel companies via capital markets with limited scrutiny.

Right now, three US banks — Citi, Bank of America, and Morgan Stanley — count all of their underwriting activities for clean energy toward their sustainable finance pledges, but avoid accounting for the same level of impact for their high-carbon financing and emissions reduction targets for polluting sectors. Essentially, these banks are taking all of the credit for their facilitation of clean energy, while avoiding the blame for their facilitation of fossil fuels.

Methodology on facilitated emissions coming soon

The report comes at a key time in the conversation around big US banks’ role in the climate crisis. Banks currently point to a lack of industry standards on underwriting to justify why they do not disclose or set targets for facilitated emissions. PCAF aims to address these challenges, and will soon release an updated methodology on facilitated emissions.

“Underwriting is a huge missing piece of net-zero transition plans, allowing big US banks to continue to help fossil fuel companies raise billions of dollars with limited scrutiny. By only focusing on emissions reduction targets for their lending activities, banks are conveniently excluding half of their fossil fuel financing from their climate commitments. It’s time for the major Wall Street banks to adopt a robust and consistent methodology for accounting facilitated emissions, and take full responsibility for the climate impacts of their underwriting decisions.”

– Adele Shraiman