The 14th annual Banking on Climate Chaos report is the most comprehensive global analysis on fossil fuel banking. Endorsed by 624 organizations from 75 countries, it finds that over the past 7 years, the world’s 60 biggest banks poured over $5,500,000,000,000 into the fossil fuel industry.

A significant portion of bank fossil fuel financing over the last six years came in the form of bond and equity underwriting, as opposed to lending. In 2022, however, bond issuances dropped in proportion to loans, compared with the overall trend since 2016. This is consistent with an economy-wide pattern for bond issuances. Yet, many bank fossil fuel exclusion policies apply only to lending, which leaves a massive $2.7 trillion loophole for banks that do not include underwriting in their climate policies.

Only seven banks of the 60 analysed – Barclays, Canadian Imperial Bank of Commerce (CIBC), JPMorgan Chase, La Banque Postale, TD Bank, Goldman Sachs and Wells Fargo – include both lending and underwriting in the scope of their targets, whereas over a third of the financing for the fossil fuel industry identified in this report is in the form of underwriting.

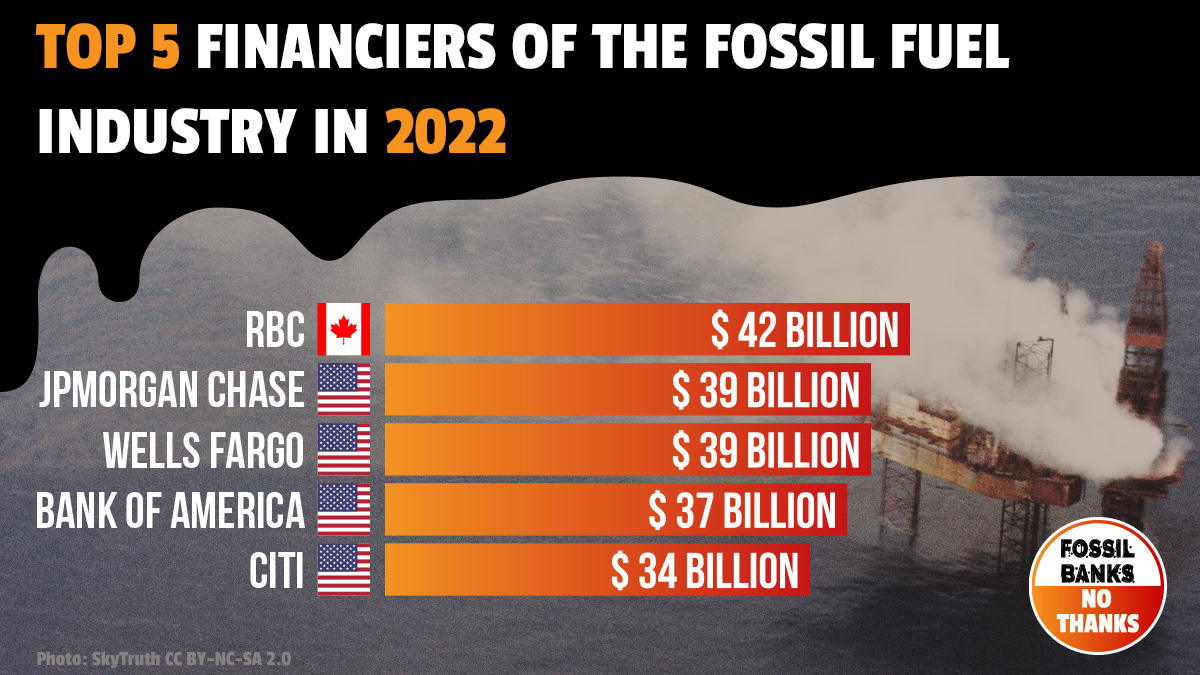

For the first time since 2019, a Canadian bank is the #1 annual financier of fossil fuels rather than US bank JP Morgan Chase. Royal Bank of Canada (RBC) showered fossil fuel projects with $41 billion dollars in 2022, including $4.8 billion for tar sands and $7.4 billion into fracking. Canadian banks are becoming the banks of last resort for fossil fuels, providing $862 billion to fossil fuel companies since the Paris Agreement.

The report shows that overall, U.S. banks dominate fossil fuel financing, accounting for 28% of all fossil fuel financing in 2022. JPMorgan Chase remains the world’s worst funder of climate chaos since the Paris Agreement. Citi, Wells Fargo, and Bank of America are still among the top 5 fossil financiers since 2016.

In the seven years since the Paris Agreement was adopted, the world’s 60 largest private banks financed fossil fuels with USD $5.5 trillion. The report lays bare the shocking fact that even as fossil fuel companies made $4 trillion in profits in 2022, banks still provided $669 billion in financing.

Banking on Climate Chaos is authored by