Today, the Toxic Bonds Network has released its latest update of the bonds issued by the Dirty 30 – 30 of worst fossil fuel companies funding their expansion on the bond market.

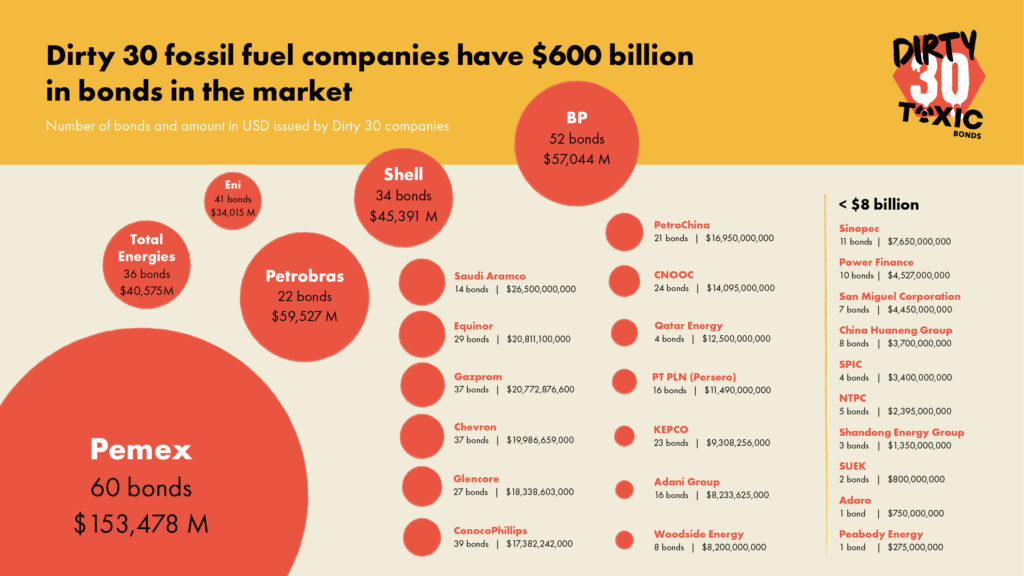

The new update reveals a staggering $600 billion in bonds these companies have in the market.

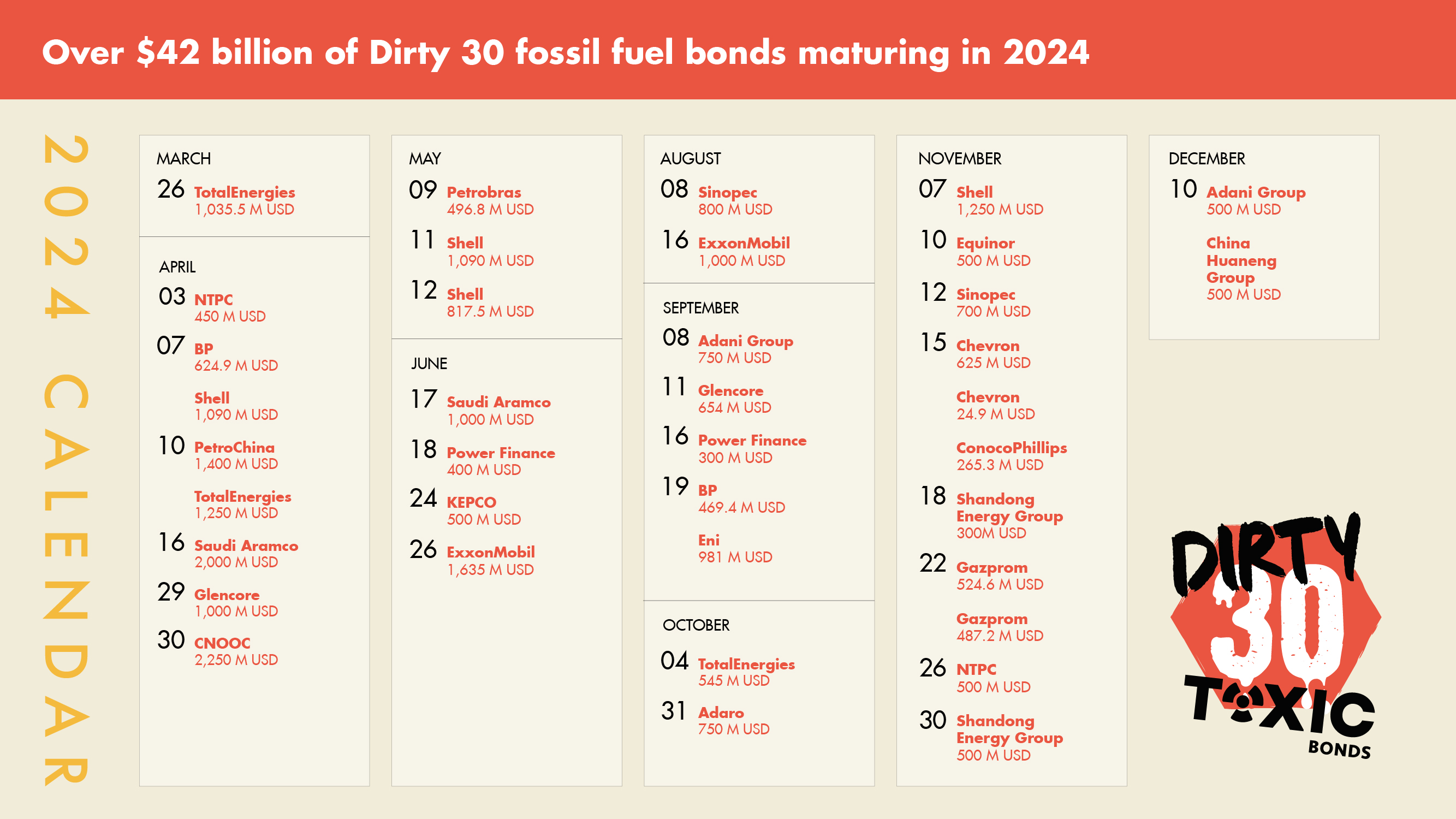

This year, the stakes are higher than ever, with over $42 billion in bonds maturing in 2024. Amidst this, an alarming $17 billion in new bonds were issued since the last update in October 2023, raising urgent concerns about the banks and investors that continue to finance fossil fuel expansion.

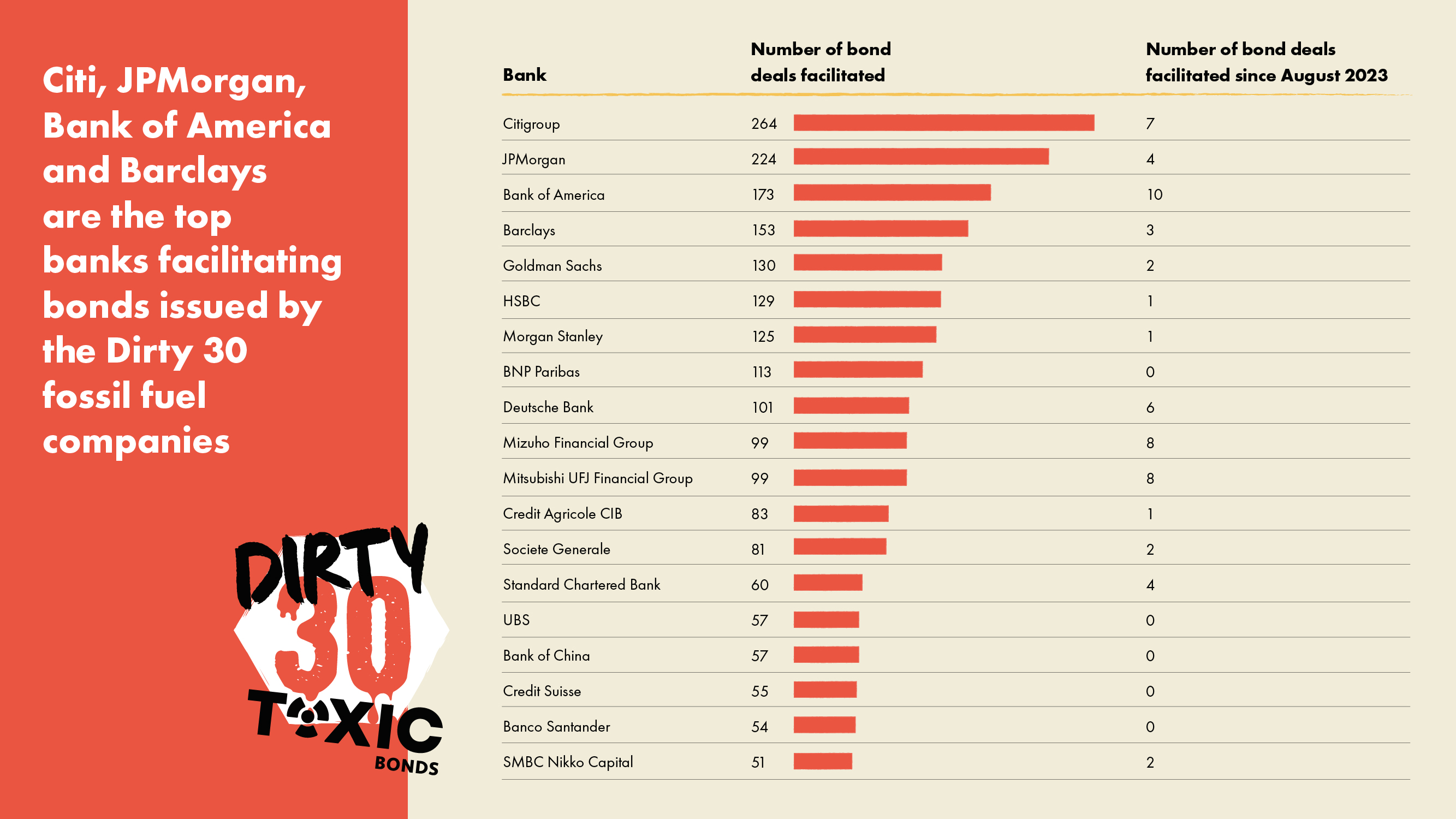

Citi, JPMorgan, Bank of America, and Barclays top the list as the banks underwriting the most Dirty 30 bonds. Despite some progress on halting coal lending, these major banks have either very weak or non-existent exclusions of coal, oil and gas underwriting, leaving the door open to continued finance of climate destruction.

The new members of the Dirty 30

Adaro: The Coal Colossus’ Veiled Agenda

In the heart of Indonesia, Adaro, the country’s second-largest coal mining company, stands tall, preparing to refinance a whopping $750 million bond maturing in October 2024. But beneath its towering presence lies a tale of environmental upheaval and greenwashing. Adaro’s ventures, particularly its so-called “green” aluminium smelter powered by a new coal plant, starkly contrast its environmental claims, laying bare the harsh realities of land clearing, biodiversity loss, and community displacement. The haunting silence of Wonorejo, now a ghost village, echoes the urgent call for change.

Learn more about Adaro here.

ConocoPhillips: Fueling the fire with tar sands

ConocoPhillips, with 39 outstanding bonds worth over $17 billion, recently issued a bond aimed at acquiring the Surmont oil facility. This new acquisition now starkly violates the oil sands exclusion policies of many of its own investors. The pursuit of oil sands, a notoriously carbon-intensive source of fossil fuel, directly contravenes the sustainability commitments of numerous bondholders that made this project possible. This breach of trust underscores a broader issue within the industry: the misalignment between stated environmental policies and actual investment practices, pushing us to question the integrity of these commitments in the face of lucrative, yet environmentally destructive, opportunities.

Learn more about ConocoPhillips here.

Eni: A legal battle amidst CO2 controversies

Eni stands with a staggering $34 billion in outstanding bonds across 41 issuances, with a notable bond worth $981 million maturing in September 2024. Many of Eni’s most recent bonds are labelled as Sustainability-Linked Bonds which have been widely ridiculed as greenwashing. Despite promoting these bonds as tools for sustainable development, Eni’s investment in one of the world’s most CO2-intensive gas fields – the Evans Shoals gas field in Australia – tells a different story. This misuse of sustainability-linked bonds not only misleads investors about the company’s environmental impact but also undermines the credibility of such financial instruments as genuine tools for the energy transition. This greenwashing has not gone unnoticed, sparking a landmark legal challenge by Greenpeace Italy, ReCommon and concerned citizens. This legal action underscores the growing disconnect between Eni’s so-called ‘sustainability linked bond’ and its continued investment in fossil fuel expansion.

Learn more about Eni here.

San Miguel Corporation: A fossil fuel behemoth’s dubious path

San Miguel Corporation’s heavy reliance on coal and liquified natural gas (LNG) for its expansion strategies presents a dire warning for the future. Despite a net-zero target, the conglomerate’s actions tell a different story, one of increased fossil fuel dependency and financial instability. The stark contrast between the company’s public commitments and its actual investment decisions serves as a critical reminder of the urgent need for a shift towards renewable energy sources. The use of such securities puts them at risk of long-term financial distress, given their high debt burdens and weak cash flows.

Learn more about San Miguel Corporation here.

The addition of these four companies to the Dirty 30 list is more than just an update – it’s a call for investors, banks, and stakeholders to look beyond the surface and to see the real impact of their financial decisions. The time for half-measures is over. The financial sector needs to immediately deny debt to all companies continuing to expand coal, oil and gas, starting with the Dirty 30.