San Miguel Global Power Holdings Corporation (SMGPH), a fossil fuel company based in the Phillippines, finds itself at the epicenter of a brewing financial storm, underscored by its heavy reliance on fossil fuel projects and a precarious financial strategy that could spell disaster for the company and its investors. A deep dive into the company’s financial maneuvers by IEEFA in a recent report, particularly its treatment of perpetual securities as equity rather than debt, reveals a troubling picture of potential over-leverage and obscured financial risk, posing a grave threat to its business model.

At a time when the global consensus is rapidly shifting towards renewable energy, SMGPH’s continued expansion of its coal and liquified natural gas (LNG) footprint is not just environmentally regressive, it’s a financial quagmire. The company’s plans to add substantial coal and LNG capacities to its portfolio are not just out of step with the global energy transition but also expose it to the severe volatility of fossil fuel markets—a vulnerability starkly highlighted by recent geopolitical events that have sent fuel prices soaring.

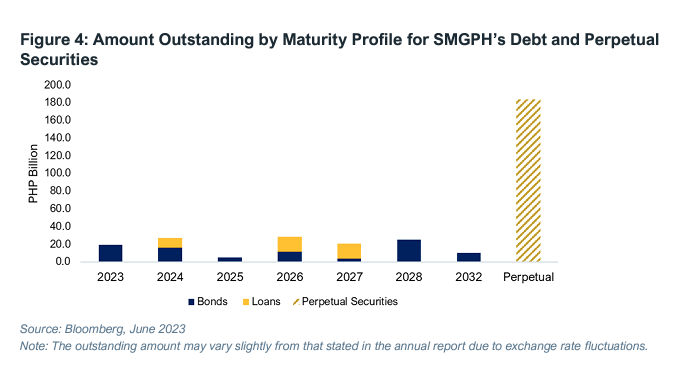

SMGPH’s financial strategy, particularly its heavy reliance on perpetual securities, is a masterclass in financial engineering that could have dire consequences. By classifying perpetual securities as equity, SMGPH ostensibly presents a more robust balance sheet than is actually be the case. This accounting maneuver allows the company to skirt the higher leverage ratios that would result from treating these instruments as debt, masking the true extent of its financial obligations and potentially misleading investors about the company’s financial health.

What are perpetual securities?

Perpetual securities are bonds with no maturity date with higher risk for investors as they will be perpetually exposed to the financial risk of the company. Although perpetual bonds do not have a maturity date, they are expected to be redeemed by the issuer on a specified call date. If issuers do not call, perpetual securities typically bear a higher coupon payment. Issuers with high debt burdens and weak cash flows are typically at higher risk of non-call actions, suggesting the issuer may be experiencing financial distress.

The use of perpetual securities as a financing tool is a ticking time bomb for both San Miguel and its investors. These instruments, while providing a temporary infusion of capital, come with the caveat of perpetual obligations, with no maturity date, effectively saddling the company with endless payments. The higher coupon payments associated with these securities, should SMGPH opt not to call them, could strain the company’s cash flows, particularly given its fossil fuel projects underperformance.

The precarious financial structure, compounded by an overreliance on fossil fuels, places SMGPH in a vulnerable position, with a significant risk of default. The company’s strategy to count perpetual securities as equity rather than debt could be its Achilles’ heel, obscuring the reality of its financial commitments and leaving investors in the dark about the risks they face. In the event of a default, investors could find themselves holding the short end of the stick, with little recourse.

The biggest investors in SMGPH’s bond and perpetual securities include BlackRock, Allianz/PIMCO, UBS, Goldman Sachs and JP Morgan.

San Miguel’s continued expansion of coal and LNG, alongside its poor financial performance, should already been enough for investors to steer clear. Investors and banks must commit to stop all financing all new debt issuances, including bonds and perpetual securities, by SMGPH, and divest from current investments in perpetual securities. This demand will not only safeguard financial institutions against the inherent risks but also act as a powerful catalyst for steering one of the Philippines’ energy giants towards a more sustainable future.