Investors and banks called on to deny new debt to ‘Dirty 30’ worst fossil fuel expansionists

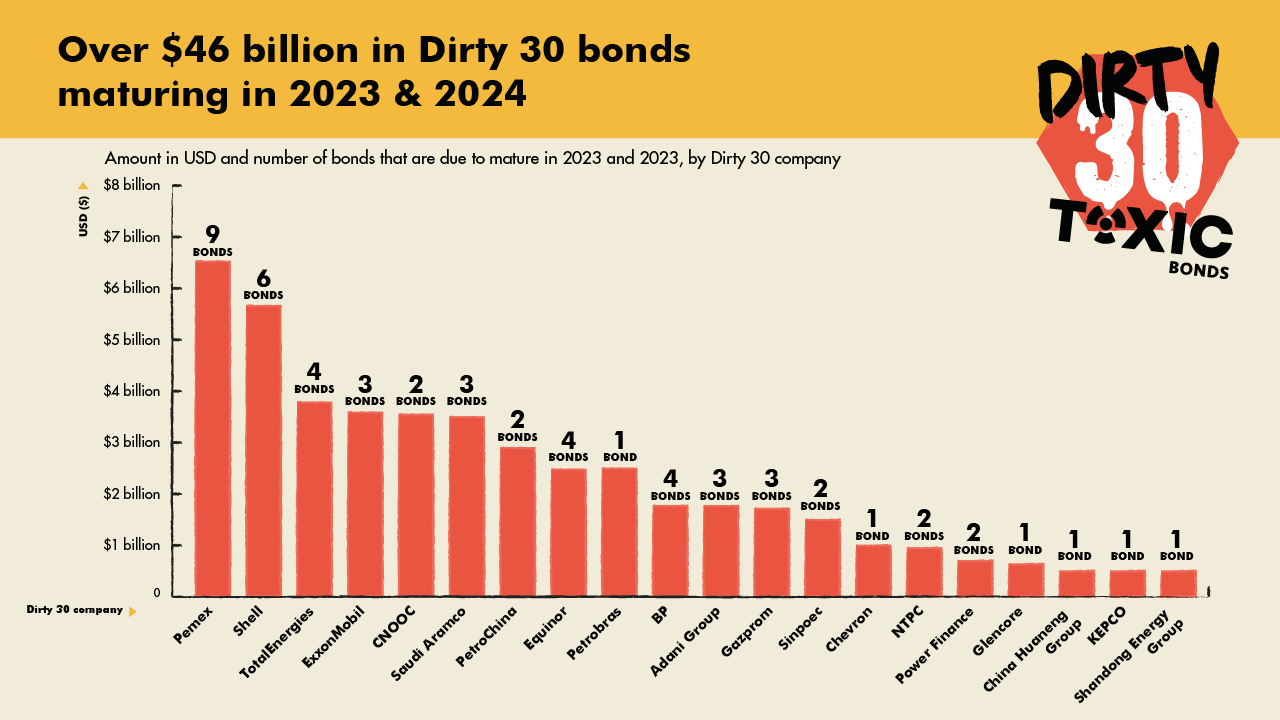

The Dirty 30 , a notorious group of the top 30 fossil fuel companies funding their expansion in the shadows of the bond market, is igniting a debt bomb. In 2023 and 2024, these corporations will likely need to refinance an astonishing $46 billion in maturing bonds to fund coal, oil and gas expansion and operations.

Updated data published today on toxicbonds.org, reveals that, as of September 2023, the Dirty 30 companies have over half a trillion in outstanding USD and Euro bonds. In the last year alone, over $8.5 billion in new bonds have been issued by the Dirty 30. Now, these same issuers are facing a major tranche of fundraising with over 8% of outstanding bonds due to mature in 2023 and 2024.

Pemex ($6.5 bill), Shell ($5.6 bill), TotalEnergies ($3.7 bill) and ExxonMobil ($3.5 bill) are facing the largest amount in USD of bonds maturing, respectively. While the Adani Group, exposed this year for its relentless agenda of fraud, insider trading, and criminal behaviour, will need to refinance over 23% of its USD and Euro outstanding debt ($1.7 billion) by the end of 2024.

“Even as net-zero and transition plans receive greater scrutiny, the alarming truth is that fossil fuel companies are capitalising on the opacity of the corporate bond market to finance their coal, oil, and gas expansion. The world’s top fossil fuel expansionists will expect an easy rollover when the time comes to refinance over $46 billion in bonds over the next two years. Companies like the Adani Group and Glencore will serve as a litmus test for investors: will they deny new debt or continue to support companies engaged in coal expansion, deception and criminality?”

– Nick Haines, Toxic Bonds campaigner at Ekō

Despite the increasing number of commitments to cease lending to the fossil fuel industry, most banks continue to underwrite fossil fuel bonds, exploiting a common policy loophole. A recent investigation found that banks have helped fossil fuel companies raise over €1 trillion in bonds since the signing of the Paris Climate Agreement. The Dirty 30 dataset also reveals the banks complicit in underwriting the fossil fuel issuers. JP Morgan, Citi, Bank of America and Barclays stand out as the top gatekeepers, respectively, each involved in underwriting over 30% of the Dirty 30 bonds on the market. These banks were also the underwriters for a significant portion of the new bonds issued by the Dirty 30 since July 2022.

“Banks prop up the Dirty 30 fossil fuel companies by underwriting their bonds. JP Morgan, Citi, Bank of America, and Barclays are the Dirty 30’s top gatekeepers to the financial world. The choice facing these banks is either to stop underwriting bonds issued by the Dirty 30 or continue down a path of complicity and – perhaps more importantly for banks – financial, fiduciary and transition risks.”

– Will O’Sullivan, Climate campaigner at Banktrack