In the wake of the one year anniversary of Hindenburg’s report exposing Adani’s fraud, corruption and insider trading and mounting evidence from the Organised Crime and Corruption Reporting Project (OCCRP), the Adani Group’s financial and environmental negligence have come under intense scrutiny. As Adani manoeuvres to refinance its bonds, notably through Adani Green, it’s imperative for financial institutions, particularly bondholders and underwriters, to recognize the broader implications of their decisions.

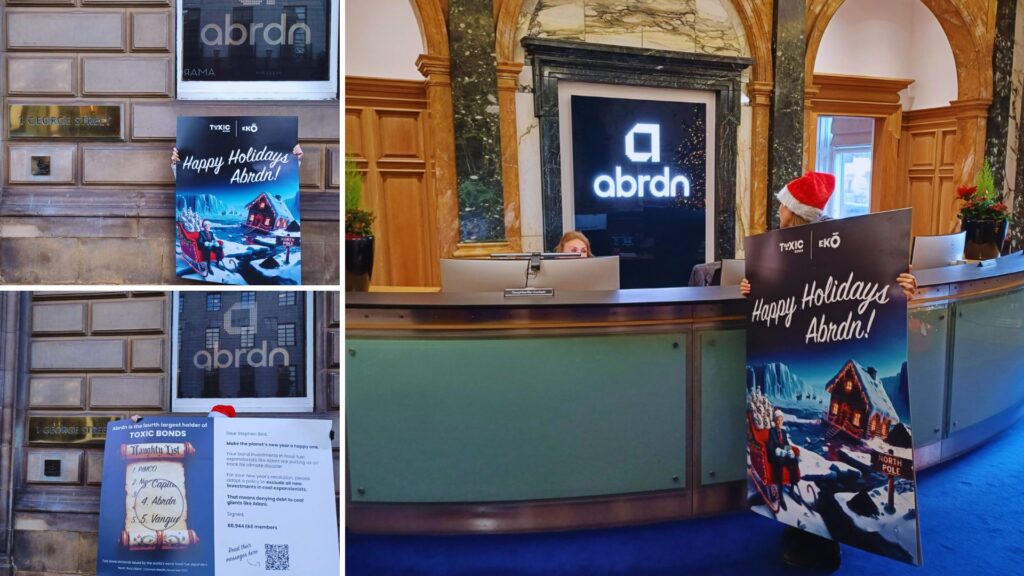

Recent holiday cards signed by over 60,000 concerned individuals and sent to TIAA and abrdn’s CEOs, Thasunda Brown Duckett and Stephen Bird, respectively, underscore the urgency of this issue. The need to reassess investing in Adani is heightened by the Group’s upcoming bond maturities of over $1.7 billion in 2024. Recently, Adani confirmed plans to raise over $410 million by August 2024 via new bond issuance to refinance Adani Green’s dollar bonds maturing in December 2024. This will be the first test of many for investors who’ve been under pressure to publicly deny debt to Adani since the Hindenburg scandal broke.

Central to this refinancing effort is Adani Green, a subsidiary presented as a beacon of sustainability. However, a closer examination reveals a disconcerting truth. The so-called ‘green’ investments in Adani Green support the group’s coal expansions. This lack of ‘ringfencing’ funds, often labelled as green bonds, for genuinely green projects is a deceptive practice that investors must condemn and commit not to refinance.

The holiday cards delivered to TIAA and abrdn with over 60,000 signatures and thousands of personal messages, goes beyond symbolic activism. It represents a tangible, growing dissent against financial institutions that continue to support Adani. This card, carrying a collective demand for a robust coal exclusion policy and an end to investments in Adani, is a powerful reminder of the public’s watchful eye and the increasing demand to deny debt to fossil fuel expansionists.

Messages from the public to Adani’s investors include:

At this time of New Year, imagine you could be a leader with your resolution to help to save our planet by stopping the funding of Adani coal.

– Eleanor, Canada

The Adani group are greedy and brutal. They have destroyed lands and livelihoods of the people. Looted public funds from National Insurance Firms and taken over government entities. As a taxpayer and citizen of India, I urge you to deny the debt to Adani.

– Aneesh, India

Coal is the most carbon-intensive fossil fuel. Our future on earth depends on phasing out the use of coal. Please deny debt to Adani. Please stop funding coal.

– Janet, United States

This Christmas, I’m hoping my 12 year old twins will have a better future to hope for. They don’t think they will: they think the best that can happen for the planet is the extinction of humans. Please help prove them wrong. Please don’t give money to Adani, or to any fossil fuels exploration/ exploitation. Help keep the planet livable.

– Nicholas, Austalia

As Adani seeks to navigate its financial challenges through bond refinancing, the choice for financial institutions is clear and pressing. Supporting Adani’s bonds is a direct endorsement of its criminal behaviour and environmental transgressions. It’s time for Adani’s biggest investors, like TIAA and abrdn, to deny debt to the coal conglomerate. Rejecting Adani bonds is not merely a financial decision; it’s a moral stance, a commitment to environmental integrity, and a step towards a sustainable future. Let 2024 be the year we adopt new year’s resolutions to collectively align our investments with our values.