The Toxic Bonds Network released a report which collates evidence that funding into Adani Green Energy is being redirected, through collateralisation and related party transactions, to other Adani Group entities directly responsible for coal expansion projects. The pretence of independence and the normal checks and balances such as credible audit controls have been shattered. The 2023 Annual Report for Adani Green Energy Limited has 82 pages of related party transactions, many directly listed as with the coal mining and coal power sister-entities.

Adani Green is the ‘so-called’ renewable energy arm of the Indian conglomerate Adani Group. Investors have been attracted to Adani Green by the promise of growth, access to the Indian market and the opportunity to support renewable energy projects.

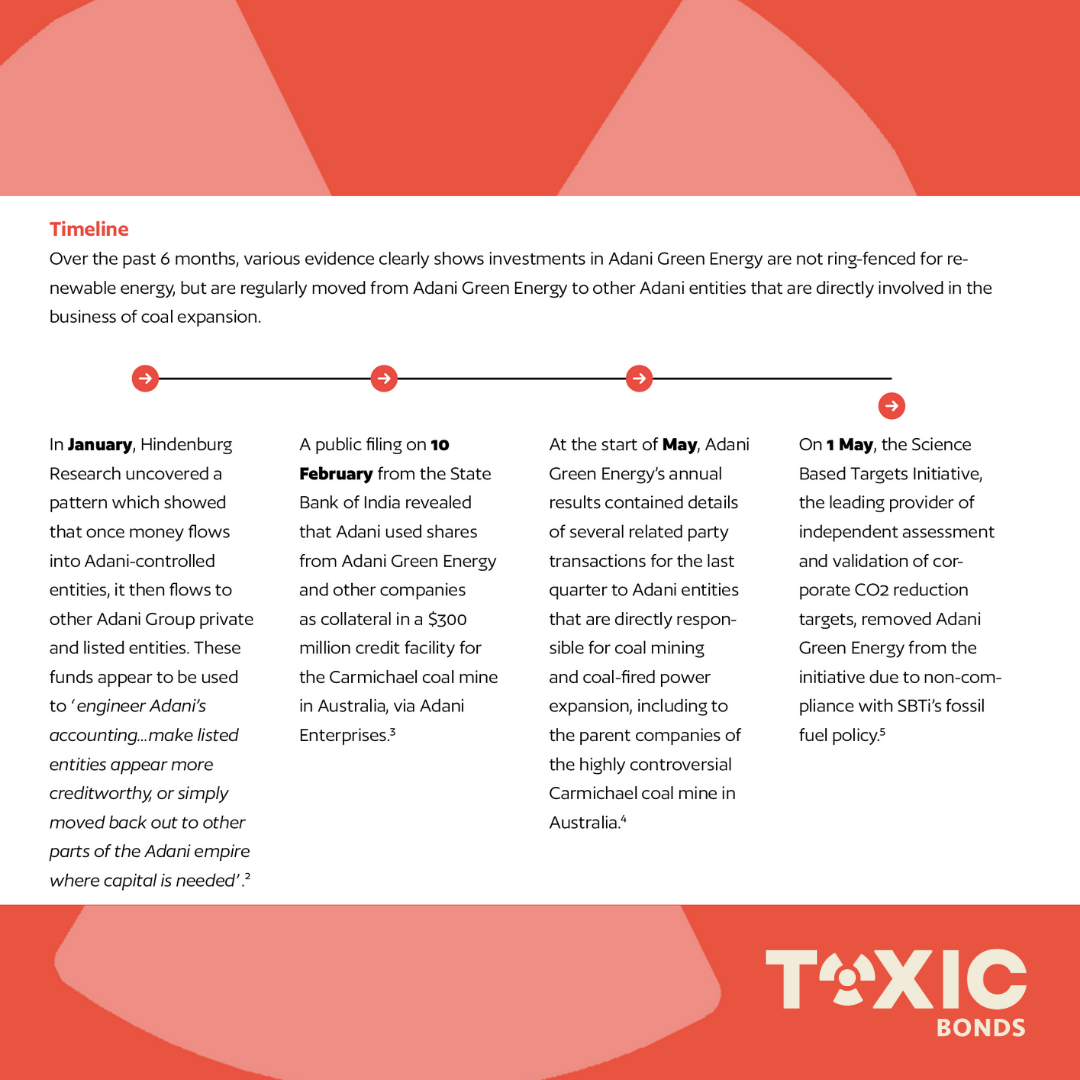

Over the past 6 months, various evidence clearly shows investments in Adani Green Energy are not ring-fenced for renewable energy, but are regularly moved from Adani Green Energy to other Adani entities that are pumping out more coal.

- In January, Hindenburg Research uncovered a pattern which showed that once money flows into Adani-controlled entities, it then flows to other Adani Group private and listed entities.

- A public filing on 10 February from the State Bank of India revealed that Adani used shares from Adani Green Energy and other companies as collateral in a $300 million credit facility for the Carmichael coal mine in Australia, via Adani Enterprises.

- At the start of May, Adani Green Energy’s annual results contained details of several related party transactions for the last quarter to Adani entities that are directly responsible for coal mining and coal-fired power expansion, including to the parent companies of the highly controversial Carmichael coal mine in Australia.

- On 1 May, the Science Based Targets Initiative, the leading provider of independent assessment and validation of corporate CO2 reduction targets, removed Adani Green Energy from the initiative due to non-compliance with SBTi’s fossil fuel policy.

Investors in Adani Green are exposed to a high level of financial and reputational risk, and should be extremely concerned, particularly those with restrictions on funding coal mining and coal-fired power expansion. Additionally, banks facilitating capital market activities for Adani Green Energy should be concerned about both reputational damage and potential liability for legal action for misrepresenting investment risks of Adani Green Energy to investors.

“Adani Green is not a beacon of light for renewable energy, but rather a lifeline to Adani’s dirty coal expansion. The evidence lifts the veil on Adani’s false and deceptive narrative ‘powering a cleaner and greener future’. Investors have been misled by Adani Green and should now be running fast from this risky investment. Investors and banks, particularly those with coal exclusion policies, must exercise their due diligence and immediately deny debt to Adani Green and sell off their existing holdings.”

– Alice Delemare Tangpuori, Coordinator of the Toxic Bonds Network.

“Allegations of the greatest financial scam in world history should make it very clear to global investors: Adani Green Energy Limited is a controlled subsidiary of the Adani Family Conglomerate. Any so-called ‘green’ investment in Adani Green directly supports the wider Adani Group to be the world’s largest private coal mine and coal power plant developer. The Adani Group is neither green nor ESG-aligned, and the Supreme Court of India is ‘unable’ to see through the sham of multi tax haven based entities and enforce the spirit of Indian securities laws. As the mountain of evidence against Adani continues to grow, it is beyond time global investors treat all of the Adani Group entities as collectively working directly against climate science and the Paris Agreement.”

– Tim Buckley, director of Australian based independent think tank, Climate Energy Finance, and long term Adani analyst.

The Toxic Bonds Network is calling on investors and banks to immediately deny any new debt or equity to Adani Green Energy and sell off existing holdings in a phased and timely manner. We are also calling on index providers to drop Adani Green from all mainstream indexes, starting with ESG funds.