A new report released by BankTrack today shows that major Asian banks – including Mizuho and MUFG in Japan, Bank Mandiri, Rakyat and Negara in Indonesia, and State Bank of India – are open for business in coal, the dirtiest fossil fuel. Despite Asia being the “growth engine” of the global coal industry and the world agreeing to transition away from fossil fuels at COP28 in December 2023, most of Asia’s major banks have either very weak or non-existent exclusions of coal from their investment portfolios, leaving the door open to continued investment in climate destruction.

Coal Havens surveys the coal policies (or lack thereof) of 30 major banks across India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan and Thailand; banks that collectively have over USD $8 trillion in assets under management. Their coal exclusion policies were evaluated by BankTrack using the criteria from Reclaim Finance’s Coal Policy Tracker, which cover banks’ finance policies on coal projects, companies’ expansion plans, whether the bank applies thresholds on coal mining and coal power companies, its coal finance phase-out strategy and the exclusion of metallurgical coal.

The report finds three trends in how coal is still getting money, in other words, three havens from the energy transition:

- The role of captive coal power is growing, especially in Indonesia;

- financiers are increasingly providing corporate finance, including bond underwriting, in place of project finance;

- the role of international banks in coal asset transactions is waning, in place of domestic and regional financiers and private equity.

The report findings therefore demand that:

- Banks adopt exclusion policies for project financing that cover all coal mining and power projects (including important loopholes like captive coal power);

- Banks adopt coal policies that exclude corporate finance – including bond underwriting – for companies on Urgewald’s Global Coal Exit List (GCEL), acknowledging that all coal expansion is incompatible with a 1.5ºC world; and

- Regional and domestic banks adopt the first two policies above, as well as a full, global and robust coal phaseout plan by 2040, that is consistent with Reclaim Finance’s prescriptions.

“The shrinking corners of the coal industry are still having money pumped into them by some of the biggest banks in Asia. The Japanese megabanks Mizuho, MUFG and SMBC, Indonesia’s “Big Four”, Banks Mandiri, Negara, Rakyat and Central Asia, and Singapore’s “Big Three”, DBS, OCBC and UOB, among others, have totally inadequate coal policies while they actively finance climate destruction – long after they should have exited coal. All these banks should urgently and permanently adopt robust coal exclusion policies, and transition rapidly to renewable energy investment.”

– Will O’Sullivan, climate campaigner at BankTrack

In the landscape of finance for coal power, project finance is “virtually dead” in comparison to corporate finance and bond underwriting

One of the biggest and most common loopholes in coal policies adopted by banks is the continuation of corporate finance and bond underwriting despite commitments to not to give any loans for specific coal-fired power projects or mines to those same companies. This is in spite of the fact that corporate finance accounts for the vast majority of the money provided to coal since 2016, according to the Banking on Climate Chaos report. Banks continue to finance the value chains for coal, oil and gas companies via substantial amounts of general-purpose corporate lending and capital markets facilitation (that is, underwriting or managing the sale of bonds issued or shares sold by those companies). Therefore, it is essential to the coal phase-out – and climate mitigation – for banks to close this loophole and restrict corporate financing for coal developers, including bond underwriting.

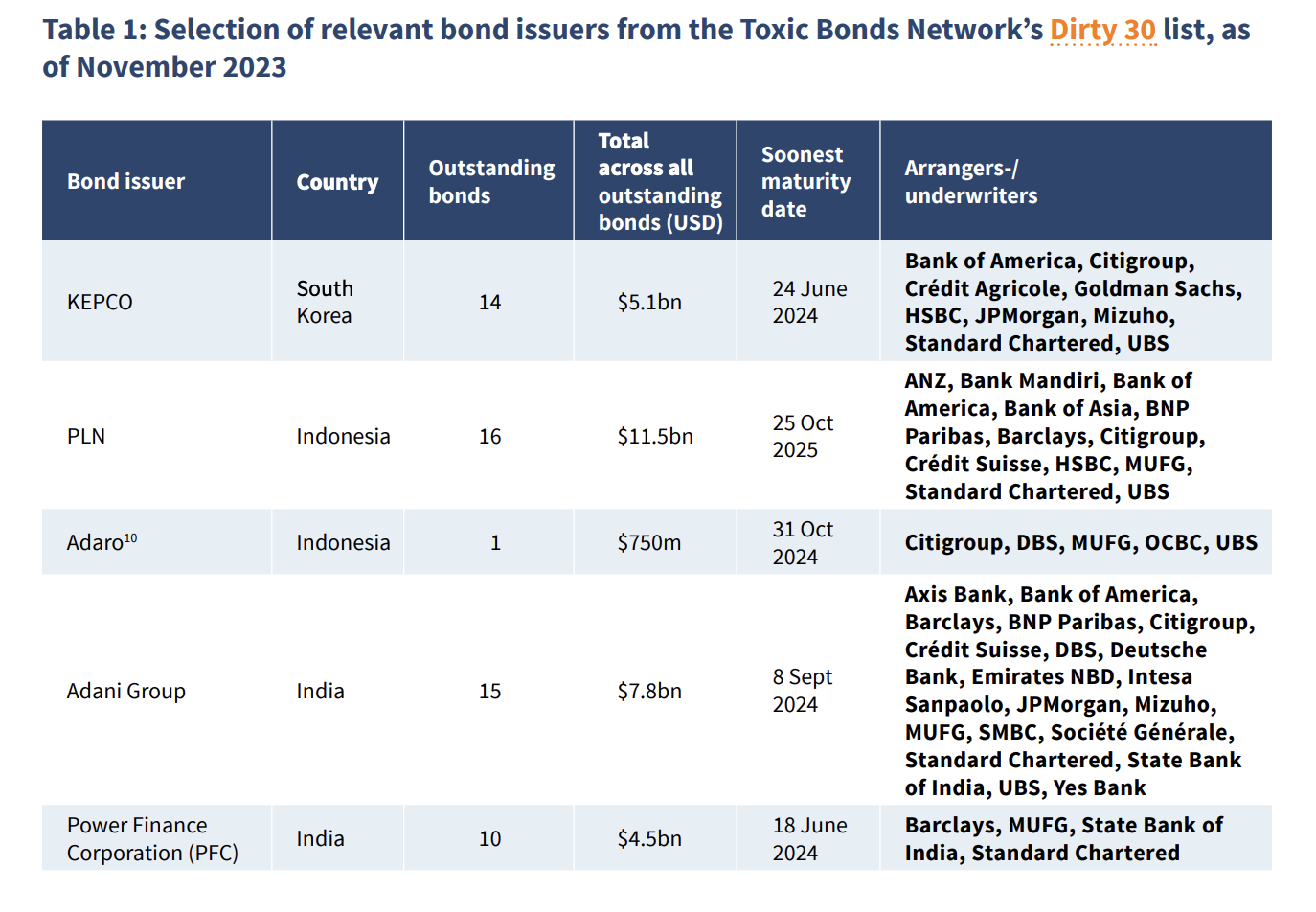

Coal developers across South Korea, Indonesia, India and China have relied on banks to underwrite their bond issuances to raise capital for their coal empires. The Indonesian state utility PLN has 16 bonds outstanding, worth almost USD $11.5bn, the South Korean state utility KEPCO has 14 bonds worth USD $5bn and Indonesia’s largest coal company by market capitalisation, Adaro, has a USD $750 million bond. In India, the Adani Group has 15 bonds worth USD $7.8bn outstanding, and has relied on its most loyal financiers of Barclays and Standard Chartered to continue underwriting those issuances, propping up the company’s vast and corrupt coal infrastructure. All of these companies have bonds maturing in 2024 or 2025. Maturity dates are key moments for the banks underwriting those bonds to withdraw their support, before being locked back into decades-long capital markets arrangements.

While the report focuses on Asian banks’ policy positions, it also highlights that major European financiers are still investing in coal: Barclays, Citi, Standard Chartered, Deutsche Bank and others are exploiting the relatively opaque and unscrutinised finance routes of corporate lending and underwriting, to finance the mining and burning of coal across the region.

“Our own research finds that national financial institutions account for 93% of the sanctioned loans to coal-based power plants in India. And the government-owned banks, including State Bank of India, still are the major lenders to privately owned coal plants. About 25-35% of Indian Bank loans are exposed to carbon-intensive sectors including coal as per Moody. Even a recent survey of the Reserve Bank of India shows that a majority of the banks have not related their climate-related financial disclosures with any internationally accepted framework. While it is good that RBI is surveying the modalities of green financing, it must take on much more of a regulatory than an advisory role if we are to be true to our climate responsibilities.”

– Anirban Bhattacharya, Team Lead on National Finance at Centre for Financial Accountability