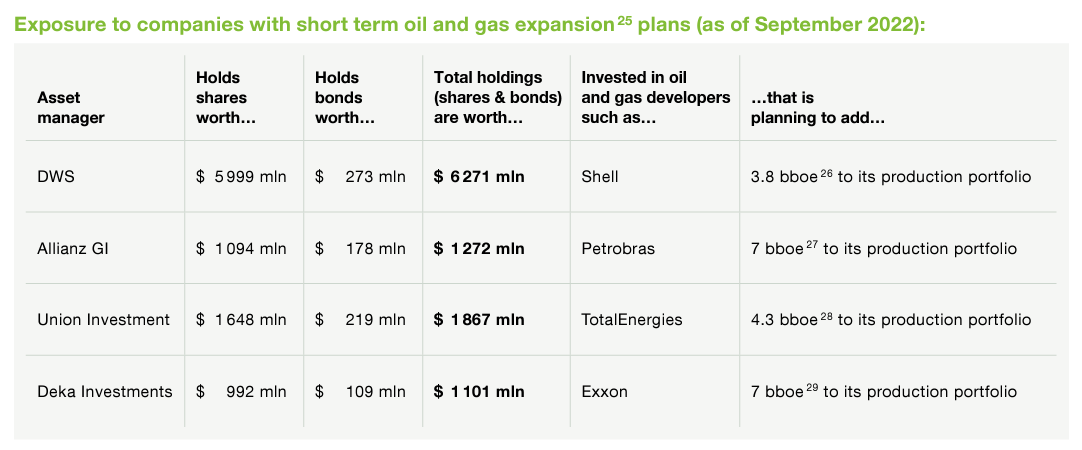

Germany’s largest asset managers Allianz Global Investors (AGI), Deka Investments, Union Investment and DWS are unrestrictedly investing in the companies with the biggest coal, oil and gas expansion plans. Their behavior undermines their official pledges to meet the 1.5-degree climate target. This is shown in a joint report by Greenpeace, Reclaim Finance and Urgewald, which examines the gap between the commitments to climate action and the fossil fuel policies of the four industry giants.

The report finds that the four asset managers are still buying new bonds from fossil fuel expansionists instead of retaining only existing investments. Far from simply holding existing securities to push companies to change through engagement, the asset managers are likely providing fresh capital to these companies, despite their expansion plans. While the asset managers should ultimately exclude all fossil fuel developers from their portfolios, they should first and foremost immediately commit to denying new debt to such companies, especially in the light of their net zero commitments.

The front-runner in coal bondholdings is DWS with USD$ 167 million. It is followed by AGI with US$ 41 million, Union Investment with US$ 33 million and Deka with US$ 75 million invested in bonds issued by companies with coal expansion plans. The four asset managers’ investment choices are at odds with the scientific consensus that any new coal, oil and gas development is strictly incompatible with international climate objectives.

All four German asset managers have joined the Net Zero Asset Manager Initiative (NZAM), in which they made a binding commitment to support efforts to limit global warming to 1.5°C. However, the current fossil fuel policies of the asset managers leave the door open for the worst polluters due to vague criteria. AGI, Deka Investments and Union Investment have weak investment restrictions for coal companies and DWS has no overarching coal policy. None of the four asset managers has investment restrictions for companies involved in oil and gas expansion.

In addition, AGI, Deka Investments, Union Investment and DWS all lack effective guidelines for engagement with companies to ensure the required emission reductions. Despite their claims of engaging with fossil fuel companies as active shareholders, none of the four have publicly asked any company in which they are invested to put an end to new fossil fuel supply projects. Those deficits are also reflected in the voting behavior of the four asset managers at the annual general meetings (AGMs) of the major European oil and gas companies in 2022, which was also analyzed in the report.