New analysis from Common Wealth calls into question the credibility of green investment strategies promoted by the financial sector

The research reveals that ‘Environmental, Social and Governance’ (ESG) funds have invested over $1.5 billion in the bonds of major coal, oil and gas companies – calling into question the credibility of sustainability claims.

ESG investment funds are an increasingly popular product sold by major asset management companies, claiming to offer a sustainable and socially responsible option for investors and a pathway for greening the financial system.

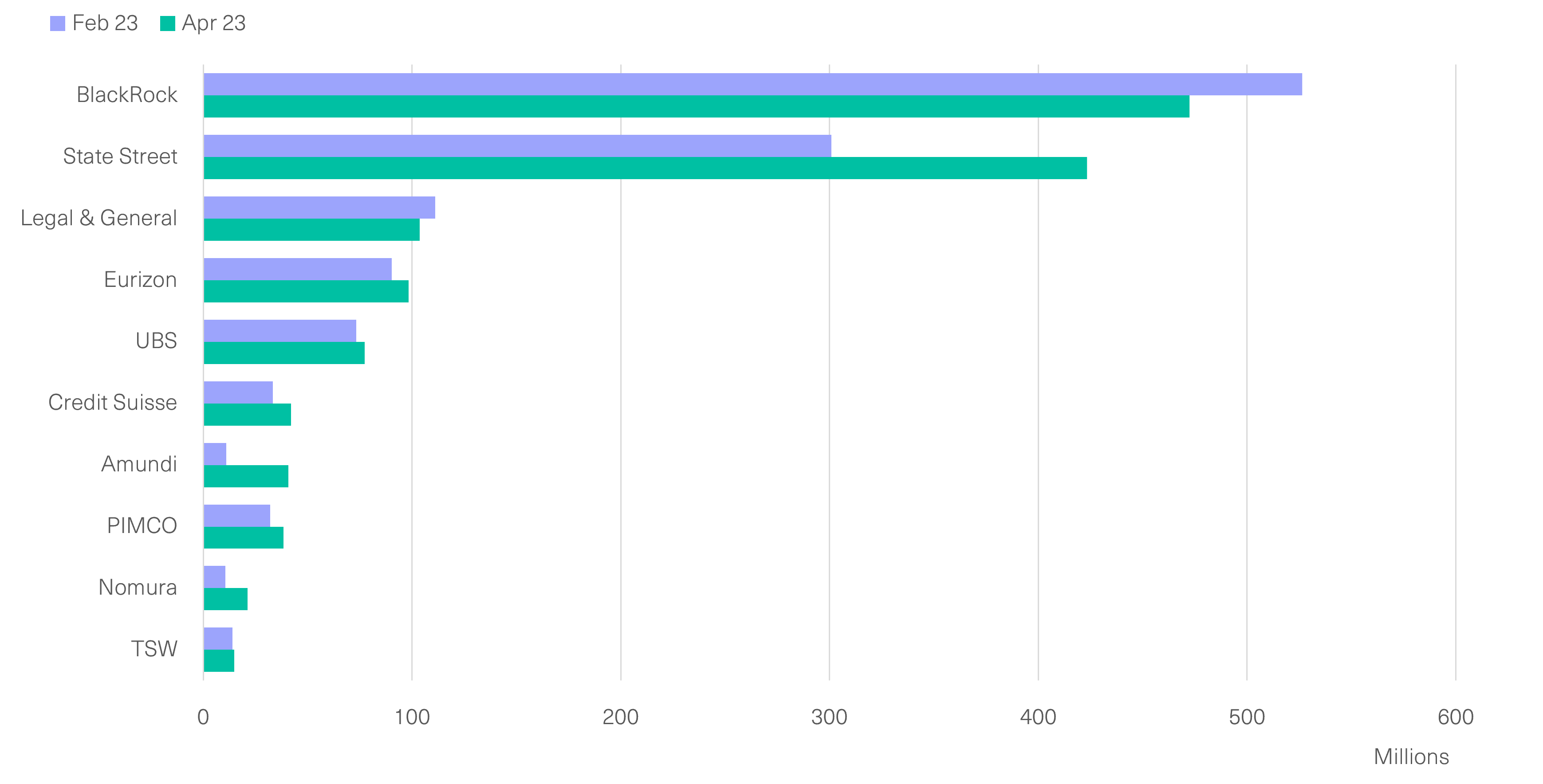

Three large asset management companies alone – BlackRock, State Street, and Legal & General alone hold almost 1 billion US dollars ($999.5m) in bonds issued by fossil fuel companies through their “ESG” labelled funds.

The new analysis from Common Wealth kicks off a research programme examining the relationship between the corporate bond market and the green transition.

Adrienne Buller, Director of Research at Common Wealth, said: “At its core…ESG investing is not a framework whose purpose is to drive change in the real economy. It is a strategy based on reducing financial impacts, not material ones – that is, the actual impacts of economic activities on the climate and environment. Sometimes these two issues overlap, but this is by no means necessary, or even common. Rather, ESG offers a mechanism for investors to minimise ‘exposure’ to financial risks — whether incoming regulation to end fossil fuel extraction or an exposé on a clothing manufacturer’s human rights violations – that could harm their portfolio’s financial returns. In other words, ask not what your portfolio can do for the climate crisis, but what the climate crisis will do to your portfolio.”

Sophie Flinders, Data Analyst at Common Wealth, said: “A quick search of Environmental, Social, Governance funds against corporate bonds issued by coal, oil and gas companies shows that these funds invest are investing $1.5 billion in coal, oil, and gas companies to date.

Rather than being a climate-conscious choice for investors, ESG funds are propping up the fossil fuel giants. Calls for tighter regulation of ESG funds from the Financial Conduct Authority and index providers are a step toward recognising the problem. But they don’t address the fundamental issue: financial returns for investors are taking primacy over protecting the climate.”

Nick Haines, Campaigner Manager at Ekō/the Toxic Bonds Initiative: “So-called ESG funds cannot be trusted. Fund managers can no longer rely on the excuse that they just blindly track an index: they have a fiduciary duty to avoid investor deception. Corporate bonds are the asset class that increasingly underpin the world’s dirtiest industries. Investors must accept their role in the climate crisis and deny debt to companies expanding fossil fuel production.”