Four major French banks: BNP Paribas, Crédit Agricole, Société Générale and Natixis have all been linked to a US$4.5 billion bond issue for the world’s biggest oil and gas developer, Saudi Aramco – despite their net zero commitments. According to the International Energy Agency (IEA), this is incompatible with the goal of limiting global warming to 1.5°C.

The bonds, detected on the Bloomberg terminal were issued by GreenSaif Pipleines and TMS Issuer Sarl, both linked to Saudi Aramco, on Thursday 23 February.

There are several points to note, starting with the very short time between the disbursement of the first loan and its transformation into a bond. This allows banks to take the transaction off their balance sheet, a clever way of reducing the exposure of their portfolios to fossil fuels and the associated emissions without actually contributing to decarbonization in the real world.

However, it should be noted that the original transaction dates from March 2022, i.e. after the four French banks committed to achieving carbon neutrality by 2050 along a 1.5°C trajectory by joining the Net Zero Banking Alliance.

Although this transaction involves two specific Saudi Aramco subsidiaries, it should be remembered that this oil group has the largest number of planned new oil and gas projects in the world, with 20 billion barrels of oil equivalent under development in the near term. Saudi Aramco currently has extremely low long-term decarbonization targets for a very small proportion of its emissions. In other words, the group is a long way from meeting the conclusions of scientists and the IEA on the trajectories to be followed to limit warming to 1.5°C. For financial actors to provide new unconditional support is, according to the UN High-Level Panel on Net Zero Commitments, greenwashing. Removing the transactions from their balance sheet through a bond issue allows them to meet their decarbonization targets.

Will these banks use the same process to remove existing transactions with other fossil fuel expansionists from their balance sheets, or worse, to continue to make new loans to these companies by banking on their conversion into bonds?

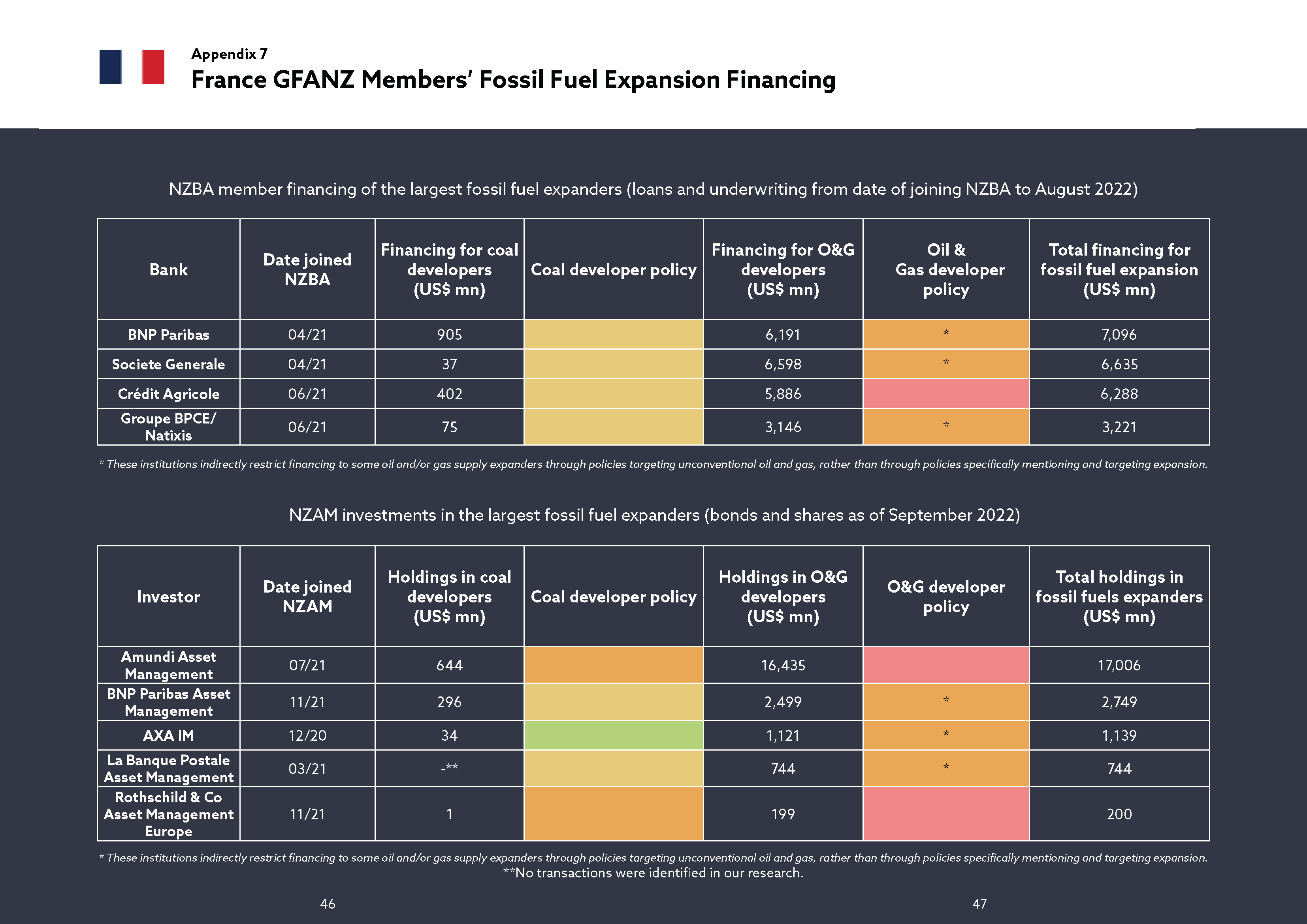

In January, Reclaim Finance highlighted that these banks had provided US$23.2 billion to fossil fuel developers since they became members of the Net Zero Banking Alliance. On 9 February, two days after BP announced major profits and a drop in its decarbonization targets, several banks, including BNP Paribas, also helped the oil and gas giant issue a US$ 2.5 billion bond.

To effectively address the climate emergency, banks need to adopt measures that cover all their financial services and complement their decarbonisation targets with measures that restrict their support for fossil fuel expansionists.