A new report released by the Toxic Bonds Network and Bank on our Future campaign finds banks have underwritten $2.7 trillion of fossil fuel bonds since the 2015 Paris Climate Agreement – offering critical lifeblood to fossil fuel companies. The report reveals that underwriting bonds for fossil fuel companies is a glaring loophole in banks’ net-zero targets and needs greater scrutiny.

Role of banks

To issue a bond, a company needs a dealmaker: investment banks. Acting as a bookrunner (also known as an arranger or underwriter), investment banks manage all aspects of the issuance process, in particular they advise companies issuing bonds and help market bonds to investors.

In a large bond deal a group of banks will not only advise a company, but can each take a chunk of the bond deal (the “book”) and assume the financial risk for selling this onto investors. Banks will pocket the profits from the transaction. Companies seek out known and experienced investment banks for this role, such as Citi, JP Morgan and Barclays.

Fossil fuel companies rely on banks’ credibility to gain access to potential investors. Underwriting bond issuance allows banks to profit without risk being carried on the books (as a private loan would). Instead the risk is passed on to the bondholders.

As calls for climate action and sustainable finance are getting louder, many large banks have developed net zero and/or coal exclusion policies. But in many cases these policies apply only to the investment activities of the bank, not financial services, like book running. This casts serious doubts on the legitimacy of banks’ green pledges and undermining the very credibility that fossil fuel companies seek to exploit.

Report findings

- Since January 2016, banks underwrote bonds totalling US$2.7 trillion for coal companies and companies leading oil and gas expansion. US$2 trillion went to companies on the Global Coal Exit List (GCEL) whilst US$700 billion went to the top 50 companies expanding oil and gas production.

- US$926 billion – nearly a trillion dollars – of those bonds were arranged for the “Dirty 30” fossil fuel bond issuers.

- Banks generated an estimated US$8.6 billion in underwriting fees from these transactions, of which US$5.9 billion related to coal companies and US$2.7 billion to oil and gas.

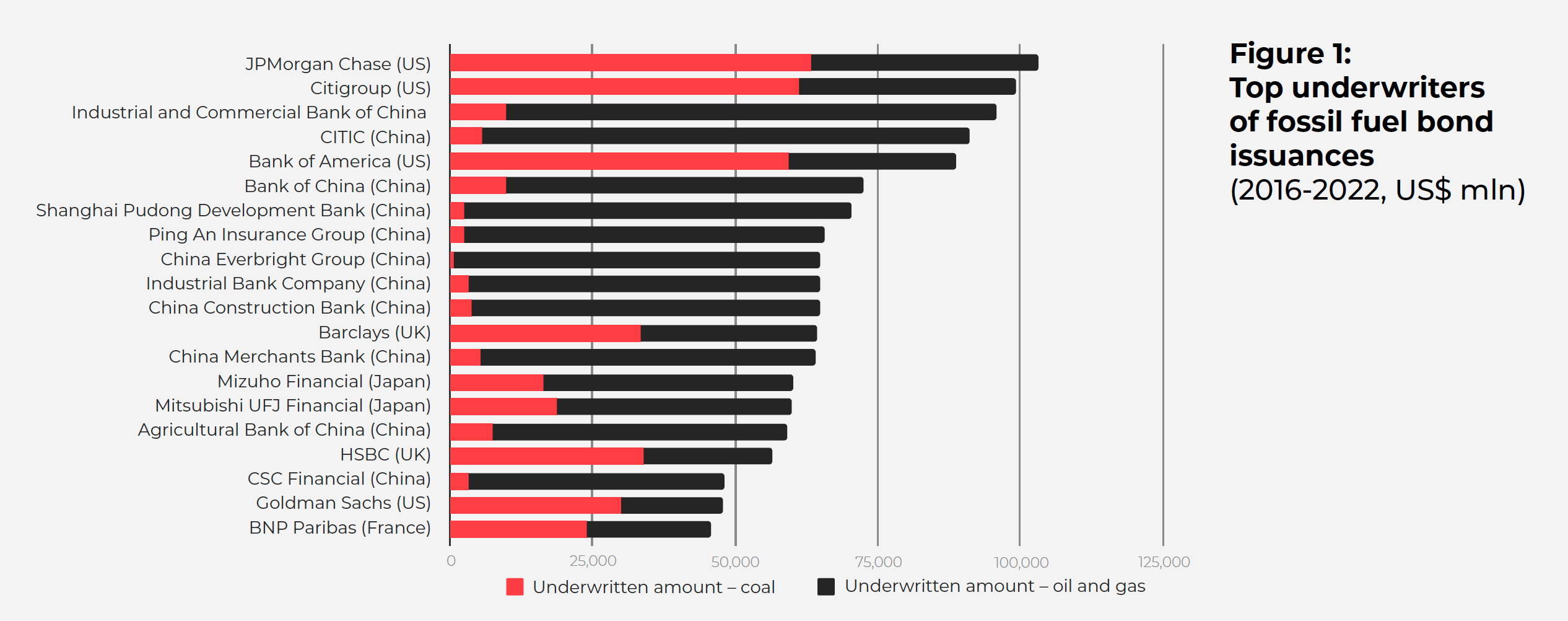

- Two American banks are most involved in fossil fuel bond transactions. Since 2016 JPMorgan Chase arranged $103 billion and Citigroup arranged $99 billion. This is followed by the Industrial and Commercial Bank of China (ICBC) that arranged $95 billion in bonds for fossil fuels.

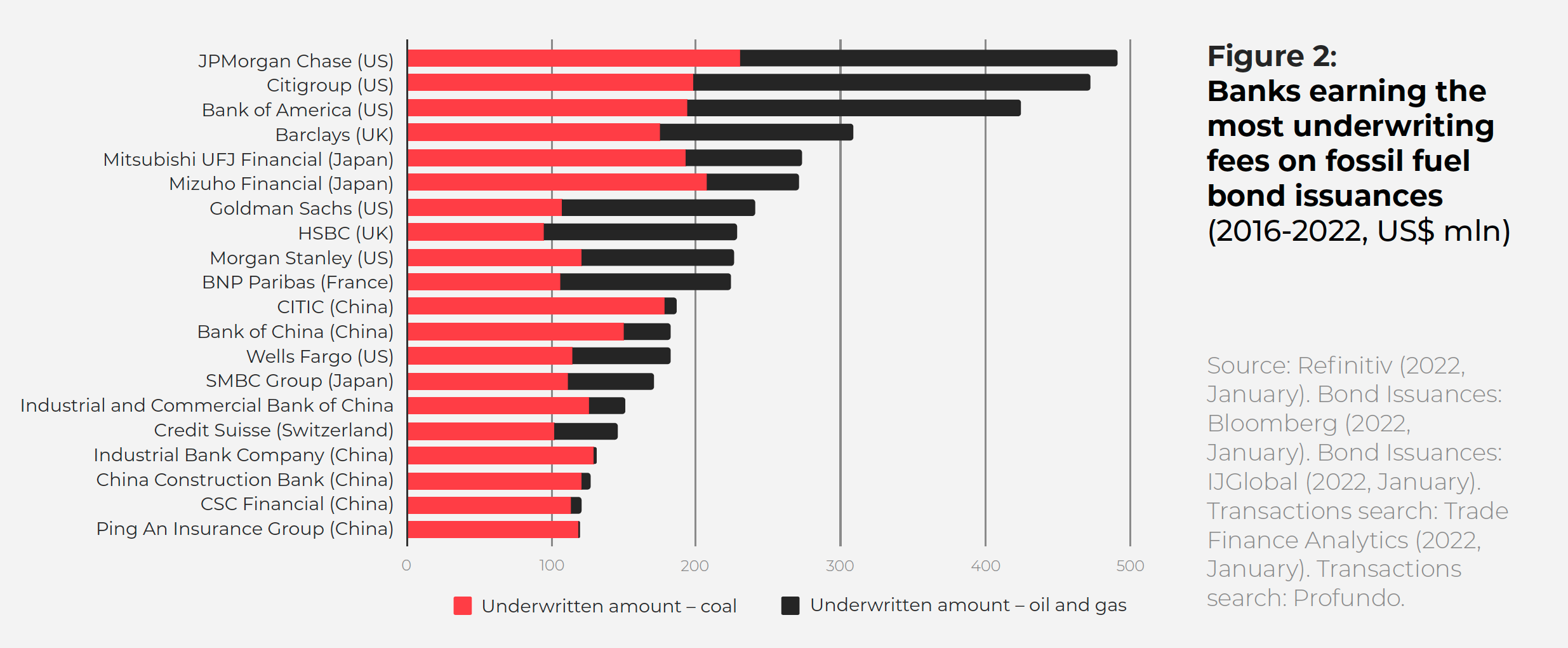

- Three American banks earned the highest fees from these transactions: JPMorgan Chase (US$492 million), Citigroup (US$473 million) and Bank of America (US$425 million), followed by British bank Barclays (US$308 million) and Japanese bank Mitsubishi UFJ Financial (US$273 million).

- Despite climate initiatives such as the Net Zero Banking Alliance, many existing climate and fossil fuel policies and targets provide loopholes, either by excluding underwriting or only applying to new clients. This allows toxic bonds to slip through the net. To be credible, banks must include underwriting bonds and shares in addition to lending in all climate policies and financed emissions reduction targets.

Despite international climate initiatives such as the Net Zero Banking Alliance, many major banks’ existing climate and fossil fuel policies and targets contain loopholes, either by excluding underwriting or only applying to new clients. This allows toxic bonds to slip through the net. The report calls into question why banks continue the practice, given the outsized reputational risk and impact on the planet, and calls for greater scrutiny on underwriting every time a bank publishes a new policy or target.

Any bank supporting expansionist fossil fuel companies is complicit in climate chaos. Banks must include all financing activity – including the underwriting of bonds – in their climate policies and financed emissions reductions targets. As a priority, the Toxic Bonds Initiative asks that all banks urgently cease underwriting corporate bonds of the Dirty 30.