Complicity in Destruction IV, published by the Association of Indigenous Peoples of Brazil (APIB) and Amazon Watch, found that mining companies – Vale, Anglo American, Belo Sun, Potássio do Brasil, Mineração Taboca/Mamoré Mineração e Metalurgia (Minsur Group), Glencore, AngloGold Ashanti, and Rio Tinto – have received a total of $54.1 billion in financing from Brazil and internationally (when combining the banks and asset managers that own shares, bonds, or provide them loans or underwriting).

The report focuses on mining companies with a history of impacts on Indigenous lands and peoples in Brazil and worldwide, and which benefit from deep connections with international financial capital. The research finds that international financiers, including BlackRock, Vanguard and Capital Group, poured USD $54.1 billion into the eight mining companies via shares, bonds, loans and underwriting.

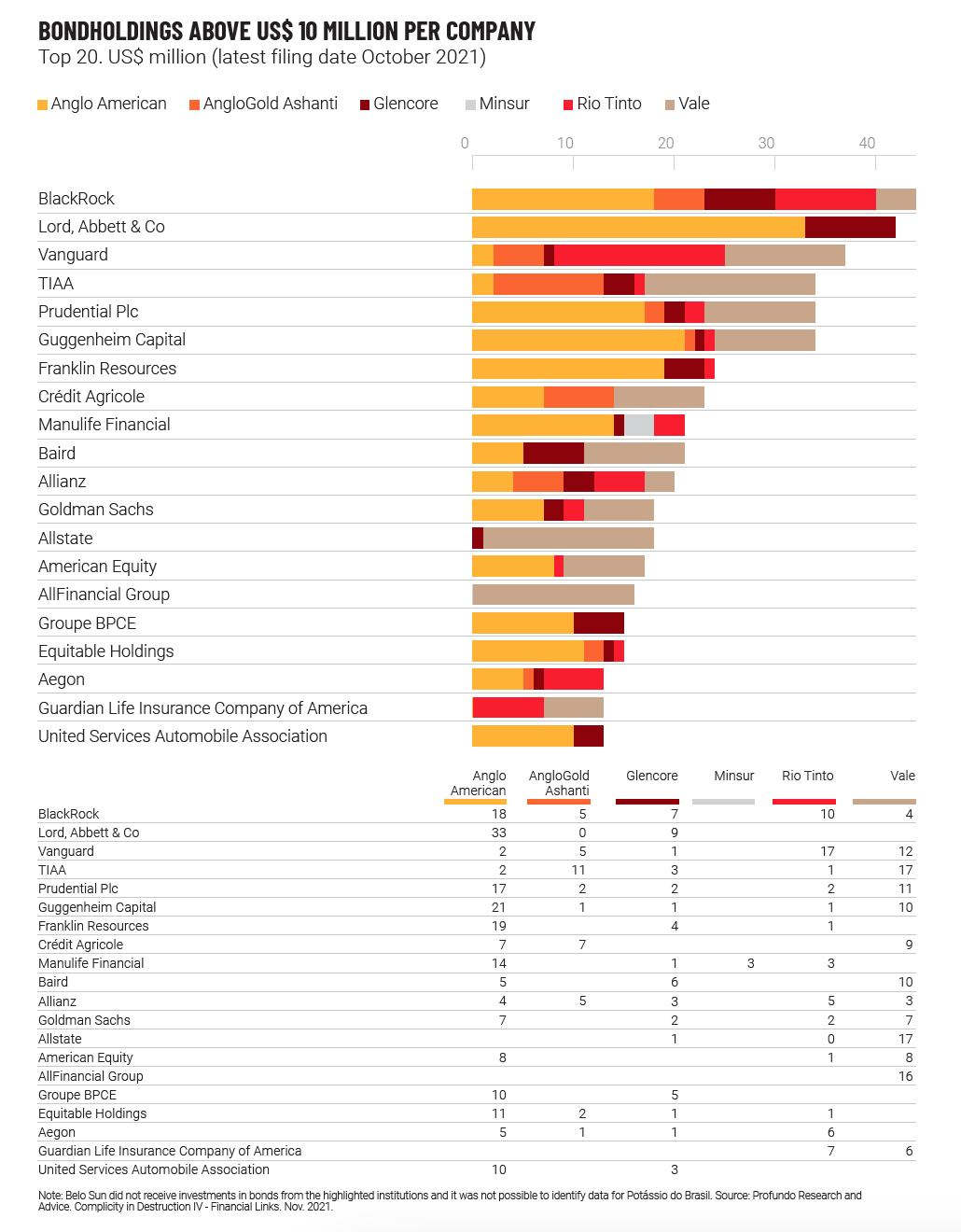

Bondholders

Bond investment made up only 2% of investments in mining activities in Brazil. The largest bondholders in the mining companies include Blackrock ($44 mill), Lord Abbett & Co ($42 mill), Vanguard ($37 mill), TIAA ($34 mill), and Prudential plc ($34 mill).

Bond issuance

Despite statements by coal companies such as Vale and Anglo American over the last few years claiming that they would withdraw their applications for research and mineral exploration in these territories, this research shows that many applications remain active in the Brazilian National Mining Agency’s (ANM) system. In some cases, there was even an increase in the number of requests.

Vale attracted the largest investments in both shares and bonds associated with its activities in Brazil, with US$31.7 billion, followed by Anglo American (US$5.3 billion), Rio Tinto (US$3.5 billion), Anglo Gold Ashanti (US$588 million), and Glencore (US$581 million). Smaller investments were identified for Minsur (US$98 million) and Belo Sun (US$87 million), while none were identified for Potássio do Brasil. It is noteworthy that in 2020 Vale concluded a corporate restructuring – started in 2017 – which enabled the company to trade a much larger number of shares in the market, attracting a great deal of foreign investment. Today, approximately 60% of Vale’s capital is under foreign control.