Coal is the most damaging fossil fuel. So a sustainable bank would want to make sure it’s not funding coal extraction right? Well, US bank Citi is a massive funder of the coal companies that are still expanding their projects.

Global Energy Monitor set out to investigate why coal projects – like coal-fired power stations – are growing (mostly in Asia), when banks have supposedly cut off financing for them all together.

The report finds that coal companies are accessing funding via a backdoor. Instead of relying on general loans, they are issuing bonds.

Global Energy Monitor found that on average 82% of the money for coal companies comes from bonds, compared to loans. And Citi plays a major role in the bond market. Banks act as a gateway to connect the issuing company with big investors and Citi is more than happy to ignore its climate commitments and oblige, because they can earn big fees on these deals.

Citi is the top funder of coal developers: The same bank that said in August that its coal policies are “in sync with climate science”. The same bank that is supposedly all about transitioning to a ‘net-zero’ economy by 2050. The same bank that is supposedly a leader among US banks on climate.

“Citi is performing sleight of hand – distracting investors and regulators with a half-finished coal policy, while behind its back facilitating a phenomenal amount of coal financing via bond markets without scrutiny. Does Citi think it can magically achieve its climate targets and ignore underwriting?” Citi are greenwashing. They are not green or sustainable. They are cutting the brakes while the world is hurtling off a cliff. Citi MUST stop funding coal now.”

– Nick Haines, campaigner at SumOfUs and member of the Toxic Bonds network

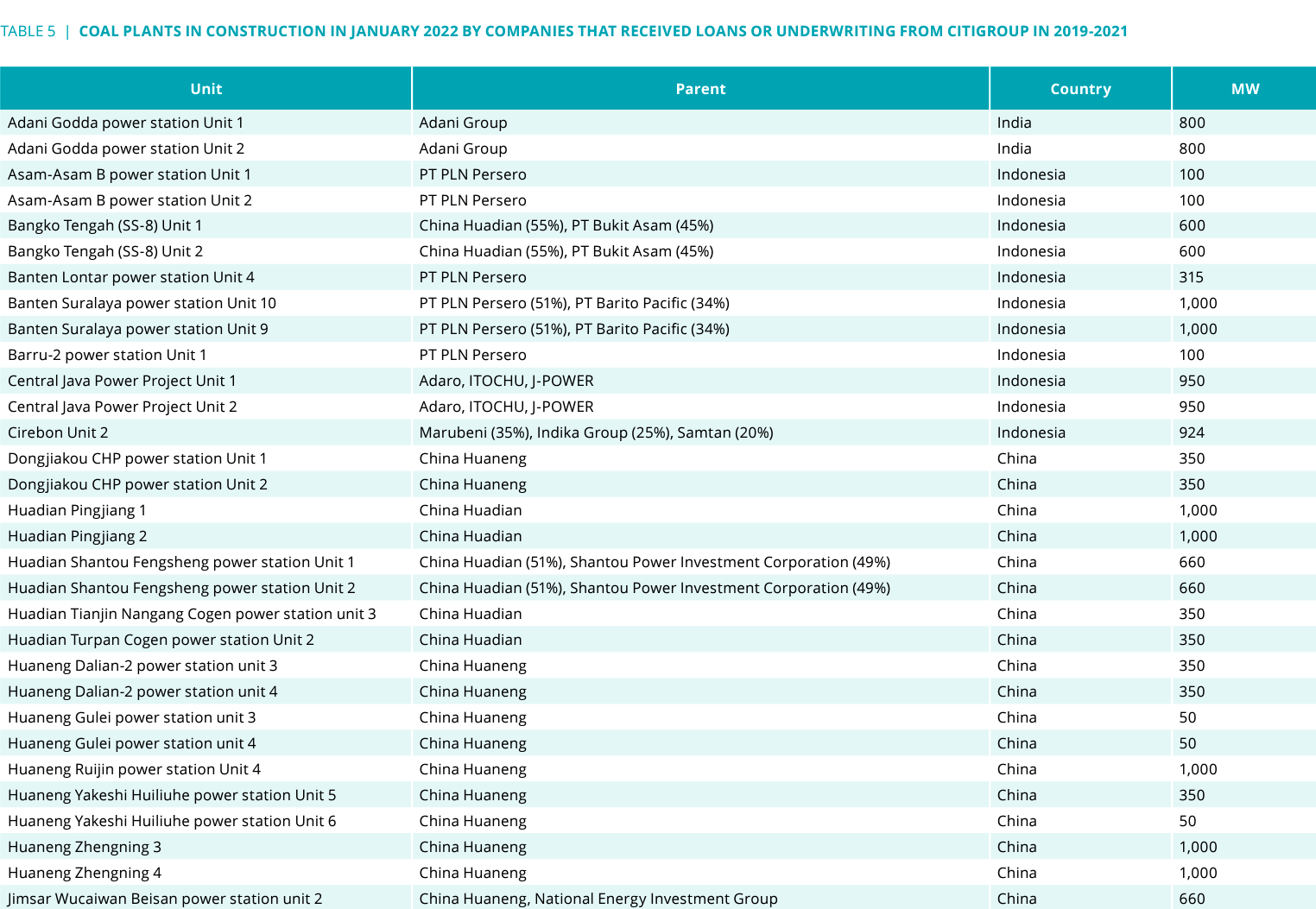

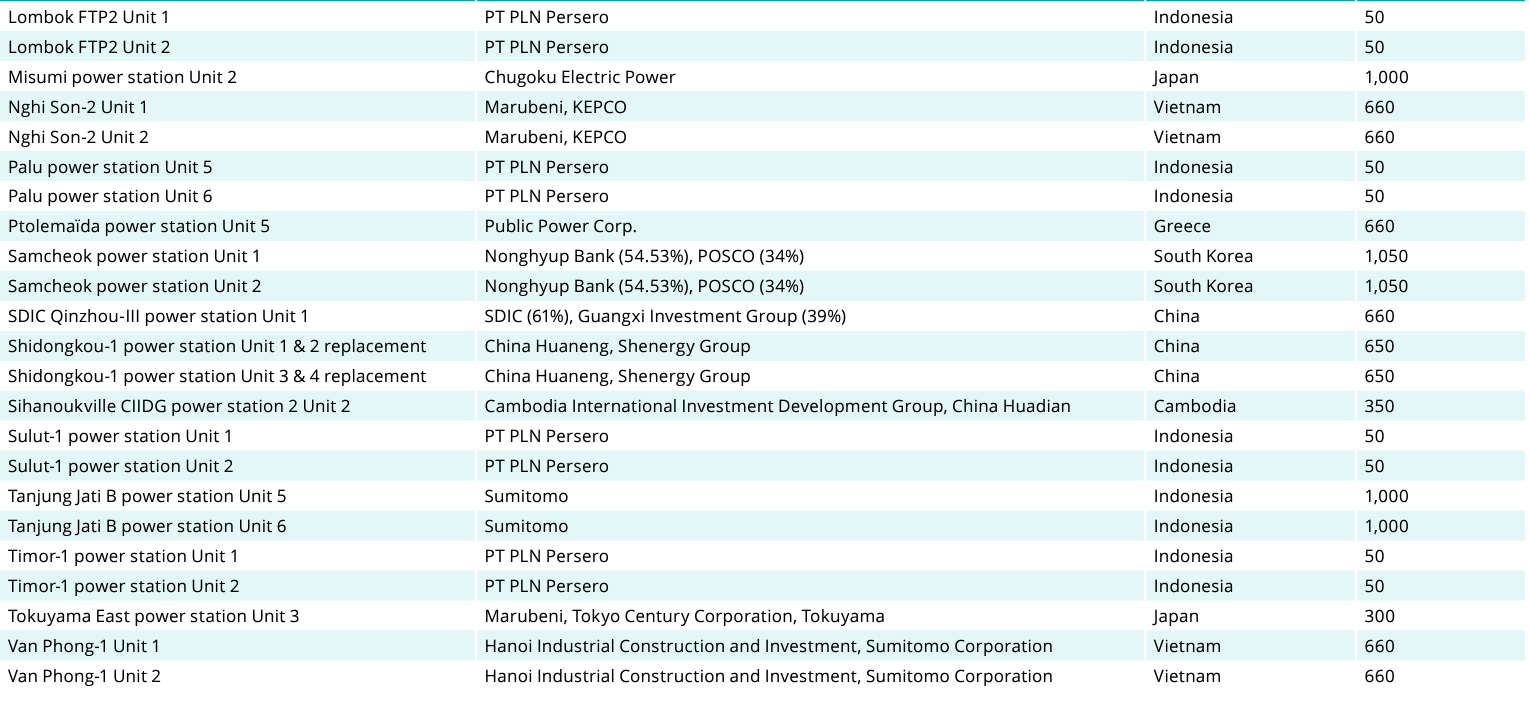

Global Energy Monitor looked specifically at which of Citi’s clients are still building new coal developments despite having to resign coal to the bin in order to stay within safe climate levels. They found that Citi had lent nearly $16 billion to these clients between 2019 and 2021.

“In 2022 it requires willful ignorance, if not outright malice, to pour billions in financing into the dirtiest fossil fuel. Yet this data shows that Citi is all in on developing completely new coal projects to lock in carbon pollution for decades. Citi is the only member of the top 20 funders of coal that is not a Chinese or Japanese bank. By providing nearly $16 billion to new coal developers between 2019 and 2021, Citi surpasses the next US bank by over 50 per cent. These numbers are outrageous for a bank committed to ‘net-zero’ and with an existing coal policy. Citi must make a hard turn closing all loopholes in their existing coal policy and stop more money going into coal expansion otherwise any remaining illusion that Citi is a leader on climate change should be abandoned.”

– Richard Brooks, Climate Finance Director at Stand.earth