Tightening SLB structures help counter greenwashing claims and reinforce issuers’ climate commitments

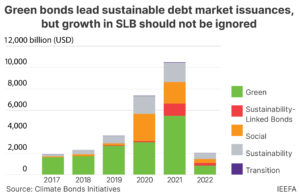

Following the introduction of the Sustainability-Linked Bond (SLB) Principles by the International Capital Market Association (ICMA) in June 2020, SLB issuances have grown significantly since 2021, finds the Institute for Energy Economics and Financial Analysis (IEEFA) in its new report.

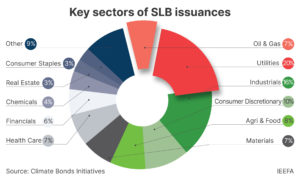

SLBs were introduced in 2019 with the objective of broadening the scope of issuers to gain access to sustainable financing. For example, companies in hard-to-abate sectors may have limited green or sustainable capex to issue green bonds, albeit with the aspiration to transition.

As forward-looking performance-based debt instruments, SLB financial structures via coupon rate adjustment depend on the firm’s achievement of a pre-defined sustainability performance target (SPT). Unlike green bonds, the use of proceeds under SLBs need not be specified and can be utilized for general corporate purposes.

Despite strong issuance growth, investors’ views on SLBs are still polarized. Some investors have remained cautious about these instruments amid concerns over credibility and greenwashing risk. These concerns have led the ICMA to release further guidance in June 2022 with an updated registry of approximately 300 sustainability key performance indicators (KPIs) for selected sectors and a supplementary question and answer (Q&A) to address queries on SLBs. Additionally, investors’ concern also led to the development of newer structures like the “use of proceeds SLBs” which combines the fundamentals of green bonds and SLBs. Although still nascent, investors consider these hybrid instruments to provide the benefits of both worlds — transparency, certainty and accountability.

The call for action to improve the credibility of SLBs is pivotal, as weak structures will impact an issuer’s ability to access new pools of capital, especially from leading ESG investors. SLB structures with loose sustainability performance targets (SPTs) could undermine an issuer’s reputation and future refinancing needs.

Weak investor demand for SLBs also exposes arranging banks to underwriting risks. For the SLB market to develop further, robust discussions amongst issuers, investors, lead arrangers, and underwriters are crucial to address credibility gaps which will help tighten and improve these debt instruments.