In a new report, Stand.earth and the Coordinating Body of Indigenous Organizations of the Amazon Basin (COICA) call on major international banks to end the financing of oil and gas extraction in the Amazon, in order to protect the remaining 80% of the world’s largest rainforest by 2025. This report comes as the Amazon is at an imminent tipping point, which threatens Indigenous Peoples, local communities, the forest and its biodiversity, and the continuity of life on the planet.

The report Greenwashing the Amazon reveals that, on average, 71% of the Amazon is not effectively protected through the environmental and social risk management frameworks of the five top financiers of Amazon oil and gas – Citibank, JPMorgan Chase, Itaú Unibanco, Santander, and Bank of America. This means these banks leave most of the Amazonian territory vulnerable, with no risk management for climate change, biodiversity, forest cover, and Indigenous Peoples’ and local communities’ rights.

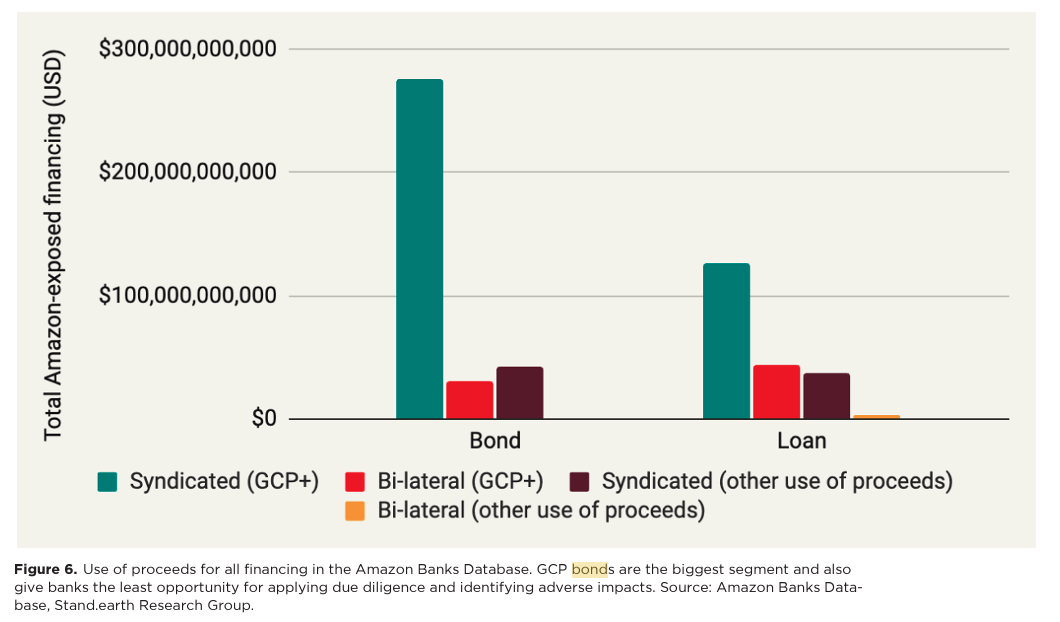

Beyond the lack of geographical coverage, the study reveals that 72% of all fossil fuel financing transactions are structured in ways that minimize the identification and prioritization of environmental and social values in the banks’ risk management frameworks. The result is that due diligence processes may not accurately identify risks to people and nature, substantially limiting the application of mechanisms like exclusions and screens, which are designed to help banks make financing decisions on transactions and clients based on the possibility of adverse impacts.

The report recommends that banks adopt a geographic exclusion covering all transactions involving the oil and gas sector in the Amazon.

Over 560 transactions involving oil and gas activities by some 280 banks over the last 20 years in the Amazon were analyzed using Stand’s Amazon Banks Database, to determine whether deal structures that bypass exclusions and screens are common. The database queries loan and bond underwriting deals in Bloomberg for companies with oil and gas activities in the Amazon regions of Peru, Ecuador, Brazil and Colombia. It parses out deal information for all participating banks.

HSBC, another major bankroller of Amazon oil and gas, is the only one in the analysis that presented a positive example of policy. In December 2022, the British bank made a commitment to exclude oil and gas financing from the Amazon. This policy has shown good results so far: no new transactions are recorded for HSBC in Stand’s Amazon Banks Database in 2023, which captures the banks involved in loan and bond underwriting transactions for companies with oil and gas activities in the Amazon regions of Peru, Ecuador, Brazil and Colombia.

Most of Citibank’s mechanisms for environmental and social risks management are only applied to project-related finance. Its geographical exclusion covers only 2% of the Amazon, while screens cover another 44% of the region. The report shows how policy loopholes and deal structures could weaken due diligence. For example, despite having a policy on Indigenous Peoples rights, Citibank still provided an estimated $125 million in financing to Hunt Oil Perú, a company set up for the Camisea Gas Project, which has violated Indigenous Peoples’ rights in the Peruvian Amazon. The transaction was a general corporate purpose syndicated bond – the most common deal structure in the database and the most limiting type of financing for bank due diligence. An estimated 55% of Citi’s direct financing to the region (est. $1.3 billion USD) is in bond underwriting deals that are syndicated.

What is a syndicated bond?

The most prevalent type of transaction found in the Amazon Banks Database is a general corporate purpose (GCP) syndicated bond, which accounts for 50% of all transactions in the database.

Banks have less leverage but incur less risk in syndicated transactions – where several banks finance or underwrite together on a transaction in order to limit each bank’s exposure. In syndicated transactions, banks have to pool leverage and agree on environmantal and social risk management (ESRM) policies to apply to the deal. These actions are subject to market conditions, e.g., the degree of competition between banks, which typically favors the client and leads to less strict due diligence as banks compete with each other.

GCP syndicated bond transactions typically do not trigger the project-related exclusions and screens common in the banks’ ESRM policies, nor do they involve rigorous bank due diligence unless there is an agreement with syndication partners, who may be reluctant to complicate or increase the cost of the transaction. Once the bonds are circulated, the bank’s ability to influence how the proceeds are used diminishes significantly, reducing long-term leverage over client activities. Nevertheless, these transactions allow the bank to maintain ESRM compliance, limit liabilities including impacts caused by the client as those risks are spread across the syndicate, and continue to engage with fossil fuel clients purportedly to help them mitigate climate risks, despite the limited effectiveness of bond underwriting in this context