The Netherlands’ largest fossil bank told to end bond underwriting for coal giant Glencore

BankTrack, ING Fossielvrij, Toxic Bonds Network, and the Artivist Network are calling on ING to stop facilitating any new bonds issued by Glencore. Glencore has 8 thermal mining projects and extensions with a planned total capacity of 63 Mtpa. Glencore is also the world’s biggest met coal producer outside of China following its recent acquisition of Teck Resources coal unit in November 2023. Glencore has 32 outstanding bonds in EUR and USD, ING has underwritten 8.

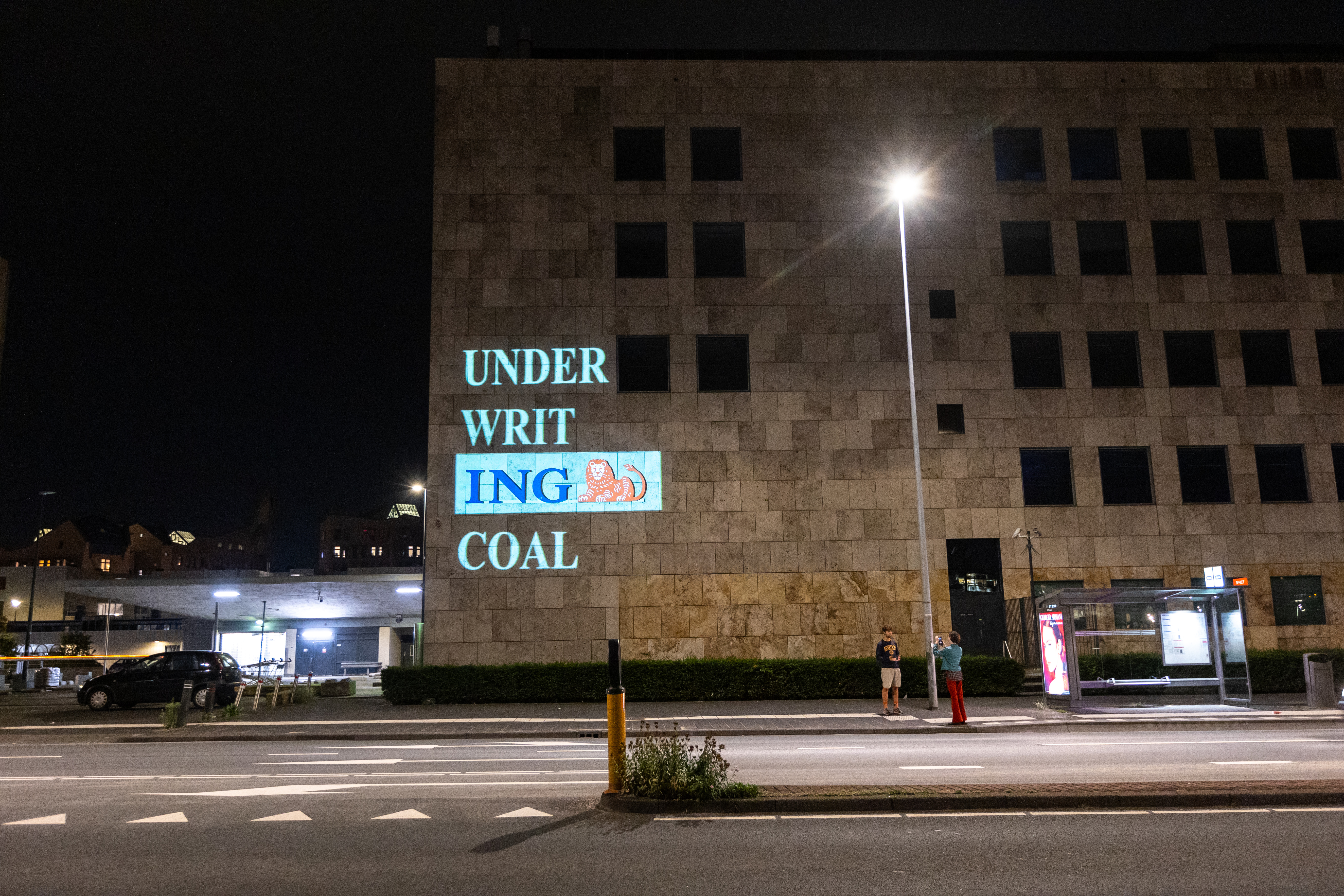

Yesterday evening, activists cast a guerilla projection onto ING’s headquarters in Amsterdam, stating “ING do your thing: Deny debt to Glencore”, and “Proudly underwriting coal till 2050”.

ING has helped Glencore raise over $5.6 billion of Glencore’s outstanding US dollar and Euro bonds, $3.2 billion of which was raised this March. Glencore has raised over $2.18 billion in finance from ING since 2016 through loans and bonds. On 11th September 2024, Glencore’s EUR 660 million bond underwritten by ING and other major European banks will mature, marking a chance for ING to decide whether to renew the debt.

“For years, ING has served as Glencore’s gatekeeper, helping it raise billions of dollars on the bond market. If ING is serious about winding down finance for coal, it needs to slam the door in Glencore’s face when they come asking for money. This upcoming maturity date gives ING the opportunity to make a clean break with the coal giant by refusing to refinance the debt.”

– Pieter Sellies, campaigner at ING Fossielvrij.

Since ING facilitated Glencore’s EUR 660 million bond in 2019, Glencore has spent billions in expanding its coal mining operations in South Africa and Australia, and bought four new massive coal mines in Canada. Far from “responsibly phasing down” coal as Glencore promises in its latest climate plan, Glencore spent $1.32 billion on capital expenditures on coal in 2023, a 26% increase from the previous year and an 83% increase from 2021. It plans to spend a record $5 billion on expansion of coal in the two years to 2026.

Alongside its destructive climate record, Glencore has demonstrated a continued lack of willingness to address serious environmental, social and governance issues across its global operations. Earlier this year at Glencore’s Annual General Meeting, communities from Colombia, Peru, the Democratic Republic of Congo (DRC), the UK and Switzerland attended to denounce the company’s legacy of pollution, corruption, and lack of compensation and engagement with communities.

ING has committed to reducing its lending to coal mining clients to near-zero by 2025 and to not finance any new metallurgical coal mines through project finance, yet in March 2024 it helped Glencore issue a EUR 500 million bond that matures in 2054 .

“By helping coal companies like Glencore issue bonds that mature well past agreed net-zero phase out dates, ING is betting against our future and profiting on the failure of the world to decarbonize. They are performing sleight of hand, distracting investors and regulators with net-zero policies that leave out coal for steel, while continuing to help issue fossil fuel bonds without scrutiny. ING cannot achieve climate targets and ignore bond underwriting. It must immediately adopt a policy to stop all new bond underwriting for any company expanding coal, including metallurgical coal.”

– Julia Hovenier, Banks and Steel campaigner at BankTrack