In a new report NZBA round 1: an assessment of banks’ decarbonisation targets, ShareAction, the responsible investment NGO, has analysed the targets of 43 global banks that are members of the Net Zero Banking Alliance (NZBA) and top financiers of the fossil fuel industry. The results are damning, revealing that despite these banks’ green claims, crucial gaps remain.

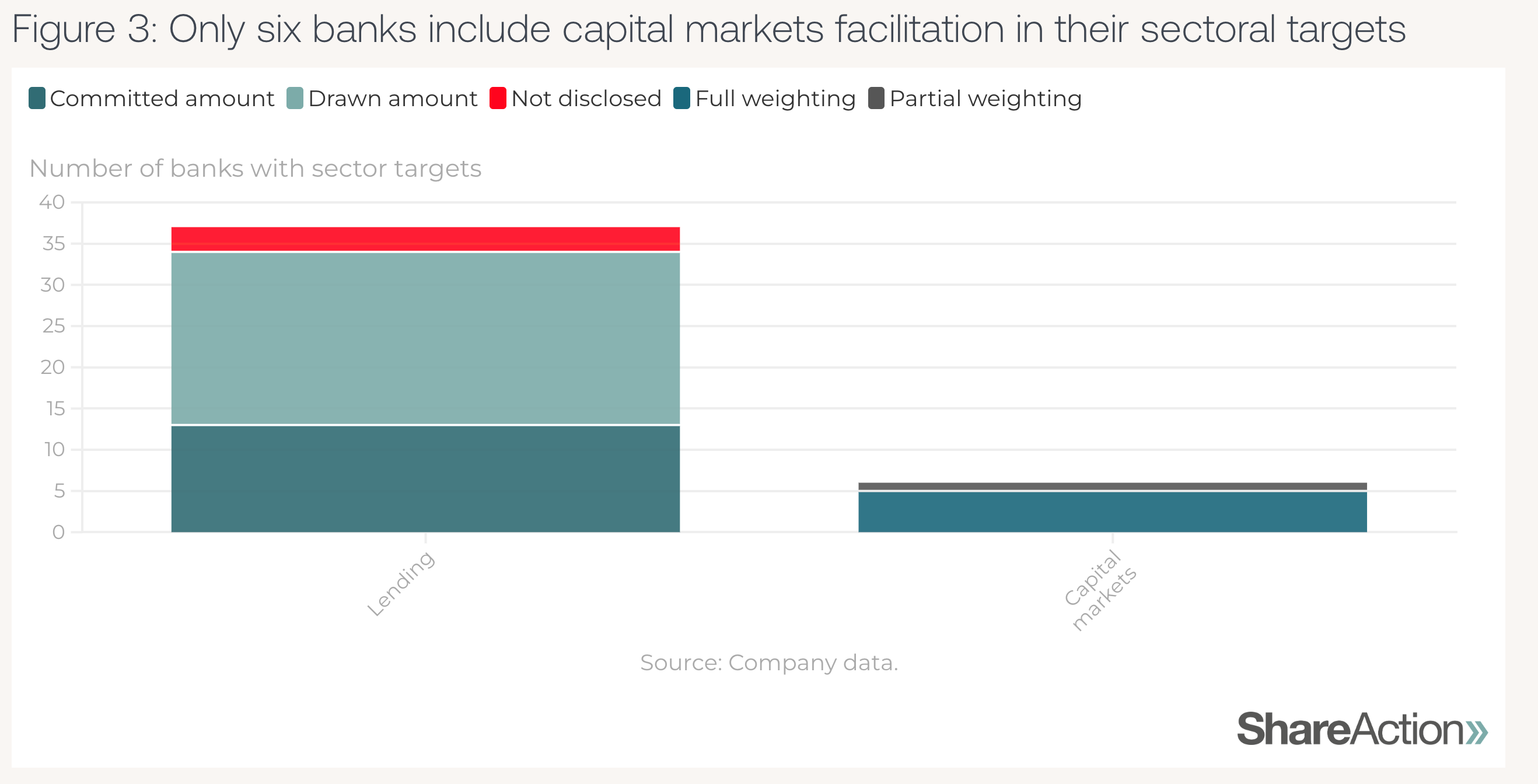

As the NZBA guidelines currently focus on lending and investment activities, it doesn’t come as a surprise that only six banks (16 per cent) include capital markets facilitation in their sectoral targets (Figure 3). Barclays, CIBC, Goldman Sachs JPMorgan, TD Bank, and Wells Fargo demonstrate leadership on this front, although Barclays only takes partial responsibility (33% pro rata share) of emissions resulting from capital markets facilitation.

Capital market activities are a significant financial activity for banks. Banks can give companies access to these markets to raise long term funds, for example through bonds, providing them a safe haven for funding. 80% of banks that have oil and gas targets exclude capital markets activities, despite these typically forming the bulk of financing provided by banks to the oil and gas industry.

In a previous report, ShareAction found that 57% of financing to the top 50 oil and gas expanders by European banks was via through capital markets rather than from traditional lending. What’s worse is that for some banks this was far more. For UBS, 94% of the bank’s financing to oil and gas expanders was in the form of bonds and other capital markets transactions. This raises the question – how much can we trust decarbonisation targets that cover less than 10% of their actual financial support to an industry?

By not including capital markets financing, UBS and many other banks are underreporting their risks and impact on climate to investors. One excuse banks often make is that there is no common methodology for how to include capital markets in their targets.

The report also finds that banks are far less cautious about including capital markets when it comes to promoting their green finance; a sure sign that all banks should move to set targets for their full financed emissions covering lending and capital markets. Crucial to the fact that only 6 out of 43 banks covered capital markets in their targets is that the NZBA, the alliance of banks set up to support a transition to Net Zero, does not yet require its members to include this in its guidelines. This is a significant omission on the part of the NZBA which is resulting in billions of finance to the worst emitting sectors being unaccounted for in banks’ targets.

The solution

The NZBA must swiftly act to require member banks to incorporate capital markets facilitation and underwriting activities, including bonds, into their targets. This is aligned with latest guidance from the head of UN to tackle greenwashing. ShareAction also found other worrying trends in the targets of the NZBA members. Many have used emissions intensity rather than absolute emissions, and only 16% have set an overarching target for 2030, none of which cover capital markets. On a broader level, ShareAction’s report highlights the failure of voluntary initiatives for their lack of bound requirements or accountability measures. Ultimately, we should be looking to governments to enact the regulation needed to ensure that financial institutions decarbonisation targets are robust – that means covering all their financed emissions.

About the Net Zero Banking Alliance

In April 2021, a group of global banks founded the Net-Zero Banking Alliance (NZBA), a UN-sponsored but industry-led initiative that is part of the Glasgow Financial Alliance for Net-Zero (GFANZ). The NZBA now has the backing of 119 banks representing ~40 per cent of global banking assets. By signing up to the NZBA, banks commit to align their lending and investment portfolios with net-zero by 2050 and set science-based emission reduction targets for 2030 or sooner for the most carbon intensive sectors in their portfolios within 18 months of joining the alliance.