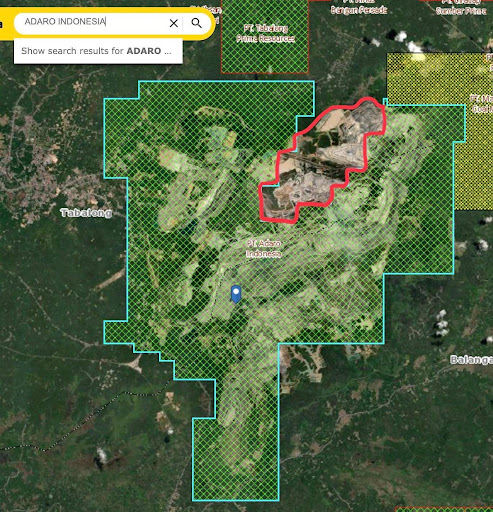

Adaro Energy Indonesia (Adaro) is a coal mining company with no credible plans to diversify and transition away from coal.

Adaro’s “green” transition pathway does not mention a cap or reduction of overall coal production. The recently released “Decarbonization” pathway of Adaro involves building an aluminium smelter in North Kalimantan, which enables a new 1.1 GW coal-fired power plant and expanding its metallurgical (coking) coal production. At the same time, Adaro continues ramping up its overall coal production.

The new coal-fired coal plant controversy has led to financial institutions propping up Adaro exiting the company, with recent examples Singaporean banks DBS and OCBC and UK’s Standard Chartered Bank both advising that they would no longer be funding Adaro.

The remaining financial institutions must commit to providing no further financial support to Adaro unless Adaro produces plans to transition away from coal in a manner consistent with the Paris Agreement goals and net zero by 2050.

Adaro’s business plan bets on catastrophic climate change

Adaro increased its coal production by 19%, from 52.7 million tonnes in 2021 to 62.8 million tonnes in 2022, and ramped up its 2023 coal production target to 62-64 million tonnes. Adaro derived 98% of its 2022 revenue from coal. Despite the statement from the International Energy Agency (IEA) that no new coal mines or coal mine extensions are necessary, Adaro has three new (greenfield) metallurgical coal mining areas yet to operate and produce coal.

These are the financial institutions propping up Adaro

Banks that have provided loans to Adaro

In April 2021, a group of 14 banks loaned a total US$400 million to Adaro’s largest subsidiary in thermal coal mining, Adaro Indonesia.

In July 2022, a group of 7 banks – CIMB, UOB, Mandiri, Permata, Bank of China, CTBC, and Qatar National Bank – continues to support Adaro and provided a US$350 million loan for a unit of Adaro Energy Indonesia, Saptaindra Sejati.

In May 2023, a group of five Indonesian domestic banks – Mandiri Bank, Bank Negara Indonesia (BNI), Bank Central Asia (BCA), Bank Rakyat Indonesia (BRI), Permata Bank – provided a total of IDR2.5 trillion and US$1.5 billion loans to Adaro’s smelter and coal power plant subsidiaries. Kalimantan Aluminium Industry (KAI), and Kaltara Power Indonesia (KPI).

These banks are enabling Adaro’s expansionary coal business, construction of a new coal-fired power plant, and backing a company whose plans undermine the 1.5°C goal of the Paris Agreement.