15 November 2023

UPDATE: MSCI has failed to remove or re-weight Adani Group companies during its November quarterly index review.

By giving Adani another pass, MSCI has failed the market. MSCI’s failure to remove or re-weight Adani Group companies during its quarterly index review on 14 November should alarm investors. As the leading provider and the “ESG gatekeeper” of the world, MSCI has completely let the market and investors down by continuing to include Adani companies in its mainstream and ESG indexes, in effect tying millions of ETF and other investors to holding Adani investments.

—

10 November 2023

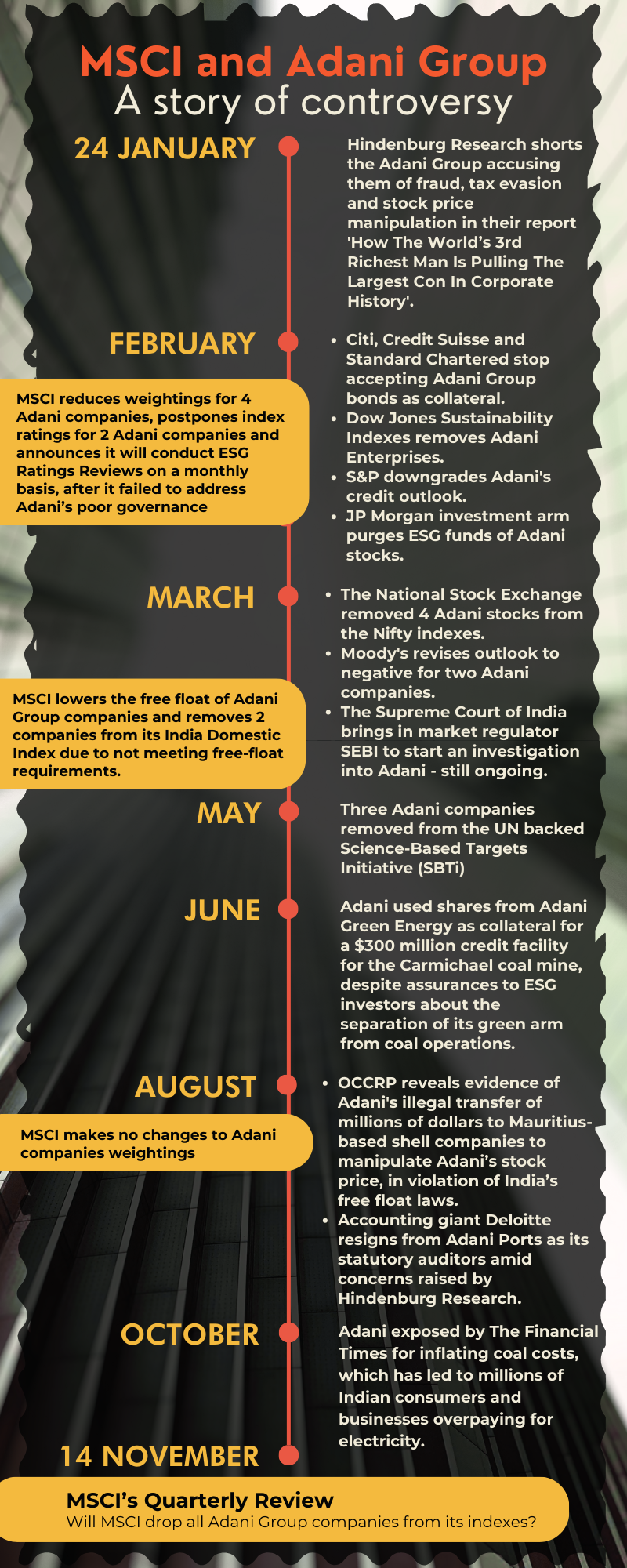

As MSCI approaches its quarterly index review on November 14, 2023, attention is drawn to MSCI’s continued inclusion of the Adani Group in its indexes. The Adani Group presents more than a financial conundrum; it is a test of the commitment to the standards that guard our markets. The unrelenting swirl of allegations — fraud, stock manipulation, free float violations — that has only continued to worsen and persist surrounding the conglomerate is not merely noise but a clarion call for due diligence.

As MSCI gears up for its index review, there is a collective pause among observers: What will this decision say about the market’s so-called guardians?

The Hindenburg Report’s exposure of Adani’s “brazen stock manipulation and accounting fraud,” combined with long-standing concerns over coal expansion, climate destruction and human rights abuses, marked a turning point in the scrutiny faced by the conglomerate. Six months later, documents obtained by the Organised Crime and Corruption Reporting Project (OCCRP) and published by The Guardian and Financial Times confirm Hindenburg’s allegations and expose a trail of deception involving hundreds of millions of dollars invested in publicly traded Adani stock through opaque shell companies based in Mauritius. This shocking news implicates Adani in a web of stock manipulation, violation of India’s free float laws and other illegal financial manoeuvres.

Despite these alarm bells, MSCI continues to include Adani Group companies in its mainstream and ESG indexes. This decision has brought MSCI’s methodologies under the microscope, questioning whether they align with the core values of responsible investing and market integrity. With over thirty thousand signatures by the public, there is a clear global call for MSCI to remove all Adani Group companies from its indexes.

From the integrity of financial disclosures to adherence to ESG benchmarks, there’s an apparent disconnect between the Adani Group’s practices and the foundational principles that MSCI’s indexes represent.

The upcoming review is more than a procedural task; it is a crucial moment to embody the prudence that investors expect from a leader in index management.

The evidence and concerns raised are not just about one company’s alleged misdemeanours but also about the broader implications for the financial markets’ integrity. The inclusion of any entity within MSCI’s indexes implicitly extends a vote of confidence in its operations and governance. How can such confidence be warranted in the face of the Adani Group’s mounting allegations?

The index review on 14 November 2023, is not just an assessment of a single group’s eligibility but a testament to MSCI’s dedication to ethical financial practices. The financial community looks towards MSCI to set a precedent in market leadership — understanding that the decision to include or exclude a company from an index can reverberate through the market, influencing perceptions and investment flows.

As the review approaches, we call on MSCI to uphold its stated commitment to empowering better investment decisions, ensuring that its indexes reflect not only the market’s present but also its potential to evolve towards greater integrity.