Asset managers are greenwashing passive funds, according to new analysis published by Reclaim Finance. Reclaim Finance examined 430 “sustainable” passive funds managed by five of the biggest asset managers in Europe and the United States and found that 70% were holding shares and bonds in companies developing new fossil fuel projects.

What are passive funds?

Passive funds replicate the composition and returns of a representative ETF (exchange-traded fund) index, such as the CAC 40, the S&P 500 or Japan’s Nikkei 225. This means that these funds simply buy, sell and hold the same stocks or bonds as the index and therefore do not require active management or frequent trading.

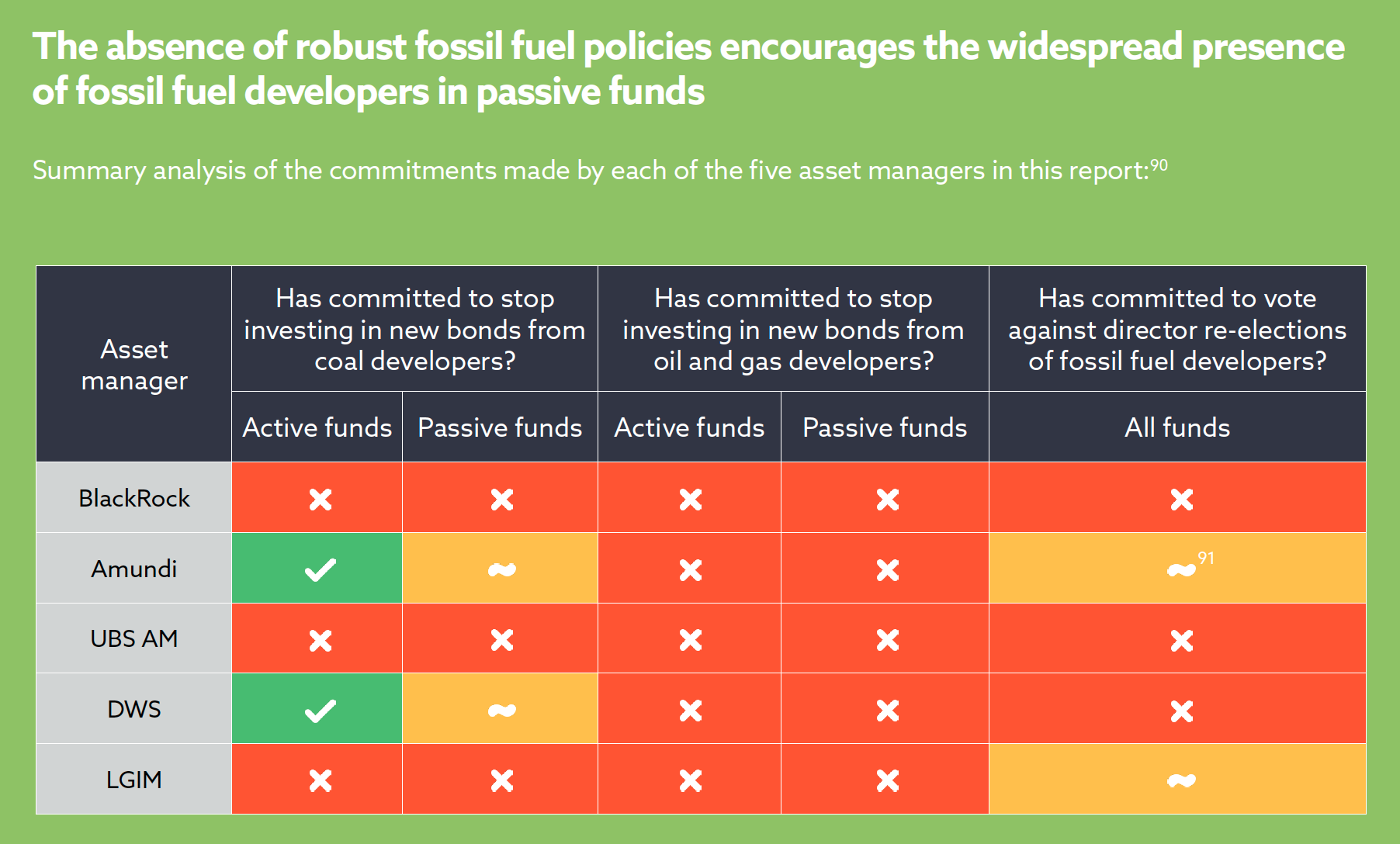

The new analysis finds that five of the biggest passive fund managers, Amundi, BlackRock, DWS, Legal & General Investment Management (LGIM) and UBS AM are turning a blind eye to the climate impact of their passive investments. These investors still held at least US$227 billion in fossil fuel developers in 2023, with more than half of this amount coming from passive portfolios.

Passive funds not only hold fossil fuel assets, but directly finance them by buying large quantities of new bonds as they are issued by fossil fuel companies on the primary market. The research shows that there is a direct link between the portfolio holdings of passive funds and their investments in newly issued bonds – including in their primary market investments – meaning there is also a clear link with direct financing of companies. And for carbon-intensive sectors, the study suggests that new bonds will increasingly be bought by passive funds as active investors avoid riskier carbon-intensive assets.

With an increasing volume of assets now managed via passive funds, the findings raise questions about the climate impact of these investments which are supporting the development of a new generation of fossil fuel production resulting in future carbon dioxide and methane emissions. The International Energy Agency’s net-zero emissions scenario indicates that there is no room for new oil and gas fields if global temperature rise is to be limited to 1.5°C. The report queries how assets managers intend to manage their decarbonisation, given that most do not apply their climate policies to passive products.

“Asset managers are fueling the climate crisis with their so called “sustainable” passive funds. While they are marketed as sustainable, these passive funds are invested in companies that are expanding fossil fuel production. Even asset managers which claim to have climate policies are part of the problem as most don’t apply their policies to passive funds. It is time for institutional investors and regulators to wake up and take action to stop these misleading claims.”

– Lara Cuvelier, Sustainable Investment Campaigner at Reclaim Finance

The analysis highlights how asset managers are relying on “sustainable” indexes to identify investments for passive funds, but these indexes do not exclude fossil fuel developers. Analysis of the index methodologies used for 25 of the ‘sustainable’ funds found that they contain “significant flaws” and are not based on scientific criteria when it comes to greenhouse gas emissions. While some asset managers have policies which commit to restricting new investments in fossil fuels (most often for coal), few apply these policies to their passive investments and therefore also make misleading ‘sustainability’ claims.

Reclaim Finance is calling on:

- Asset managers, especially members of the Net Zero Asset Manager Initiative (NZAM), to ensure they clean up their ‘sustainable’ funds. This means prioritizing efforts to ensure these funds do not contribute to new investments in companies involved in fossil fuel expansion,13 including their passive funds.

- Asset owners, especially members of the Net Zero Asset Owner Alliance (NZAOA), to engage their asset managers to ensure their assets are not supporting fossil fuel expansion, especially via any fund labeled as ‘sustainable’.

- Regulators, to take a series of actions to strengthen rules against greenwashing and forbid the sale of funds that support fossil fuel expansion, especially those labeled as ‘sustainable’.